[ad_1]

Sam Bankman-Fried — the 30-year-old dethroned billionaire who fell from grace final month with the chapter of his cryptocurrency alternate, FTX, and revelations of lacking buyer funds — was notably fidgety, hemmed and hawed over his solutions, and appeared at instances to martyr himself in a lot anticipated first public interview since his firm, valued to be value a minimum of $32 billion, merely imploded.

“I’ve had a foul month,” Bankman-Fried stated at one level, an understatement that drew a burst of laughter from the viewers on the New York Occasions’s DealBook Summit, an annual elite conclave of world company leaders, traders, politicians, and celebrities. The previous wunderkind CEO, who had graced journal covers, mingled with Washington energy gamers, and funded philanthropic causes earlier than the beautiful collapse of his alternate, advised the New York Occasions’s Andrew Ross Sorkin that he was down to at least one final bank card and about $100,000 in a checking account.

He additionally stated that his attorneys didn’t assume it was a good suggestion for him to be talking. Bankman-Fried stated he was being given the “basic recommendation — don’t say something. Recede right into a gap.”

“I feel I’ve an obligation to speak to individuals,” he stated. “I’ve an obligation to elucidate what occurred.”

What occurred was the astonishing collapse of the cryptocurrency alternate Bankman-Fried based, sending shock waves by way of not solely monetary and crypto circles however political and philanthropic ones as effectively. The corporate, at present in chapter proceedings, is being investigated by the Justice Division and the Securities and Trade Fee, in line with the Wall Avenue Journal. No less than $1 billion in FTX buyer funds seems to be lacking.

Bankman-Fried, who had been seen as a uncommon billionaire severe about utilizing his wealth to enhance the world following a philosophy often known as efficient altruism, has now left philanthropic organizations to which he dedicated cash grappling with funding gaps. FTX’s destroy has led to “crypto contagion” in the remainder of the trade, ushering in widespread instability: BlockFi, a crypto lending firm that FTX bailed out in July, additionally filed for chapter this week, and the crypto alternate Kraken introduced that it’s going to lay off 30 p.c of its workforce. (Disclosure: This August, Bankman-Fried’s philanthropic household basis, Constructing a Stronger Future, awarded Vox’s Future Good a grant for a 2023 reporting challenge. That challenge is now on pause.)

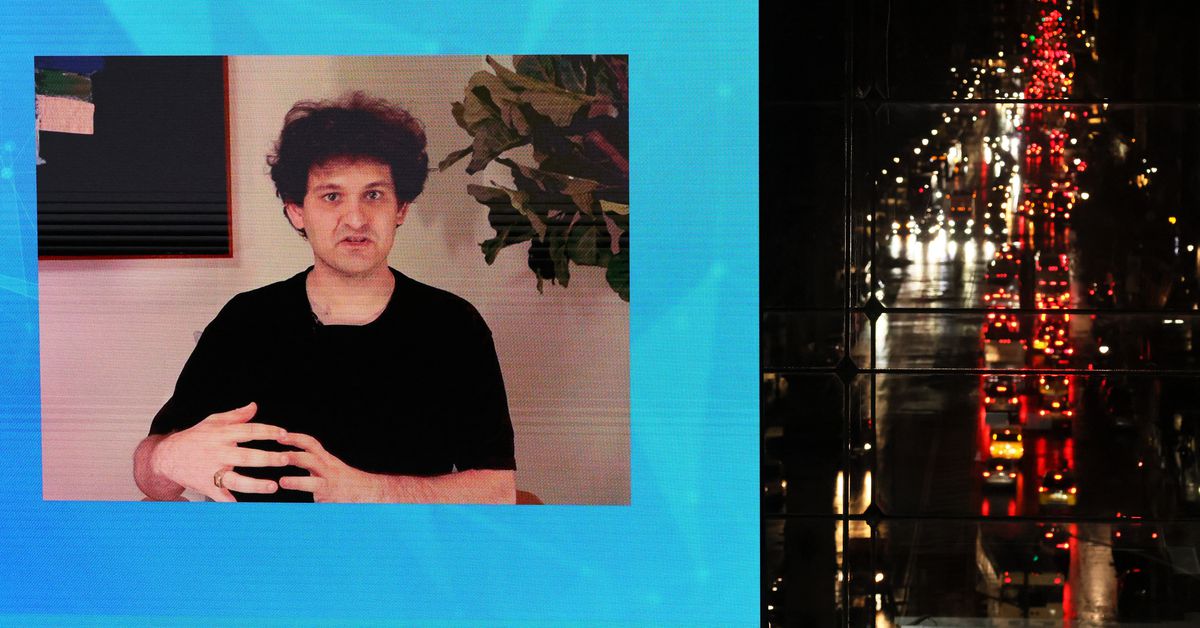

Bankman-Fried didn’t attend Wednesday’s occasion in particular person however was interviewed just about from the Bahamas, the place he’s been based mostly since late 2021. When he got here into view round 5 pm, his demeanor was subdued, in contrast with the fast-talking, frenetic power he’s recognized for throughout public appearances.

In introducing Bankman-Fried, Sorkin pulled no punches: “The beneficiant view is that you’re a younger man who made a sequence of horrible, horrible, very, very unhealthy choices. The much less beneficiant view is that you’ve got dedicated an enormous fraud.” Bankman-Fried’s solutions appeared to push for the extra beneficiant learn, however their vagueness didn’t dispel the much less variety perceptions the general public holds.

Bankman-Fried, who’s well-known for his uncommon aesthetic — he beloved to put on saggy shirts and shorts that communicated a form of asceticism — wore a loose-fitting plain black T-shirt and sat in an unremarkable room with little greater than a houseplant seen in a nook. At varied factors within the roughly hour-long Q&A, his physique language was hunched, his head and gaze lowered as he answered a barrage of adverse questions from Sorkin, together with the place FTX clients’ cash had gone, whether or not staff had used medicine, what he had advised his Stanford legislation professor mother and father, and what he noticed for his future.

At one level, Sorkin referenced a letter he obtained from somebody who accused the previous billionaire of stealing about $2 million from him, asking why Bankman-Fried had “determined to steal my life financial savings.” Did Bankman-Fried assume what he did was fraud?

Bankman-Fried’s head hung as Sorkin learn the letter. “I’m deeply sorry about what occurred,” he stated earlier than rapidly including that, “to his data,” FTX’s US platform was “totally solvent.”

Moments earlier, he stated, “I didn’t ever attempt to commit fraud on anybody.”

Bankman-Fried appeared remarkably calm for a person some are evaluating to Elizabeth Holmes and Bernie Madoff. He was repeatedly apologetic however maintained that he didn’t know the small print of precisely what had occurred and why — solely that he had failed in his obligation because the CEO of FTX, whereas emphasizing a scarcity of oversight and poor danger administration. When Sorkin talked about allegations that staff at FTX had used medicine, Bankman-Fried characterised himself as an harmless: “I had my first sip of alcohol after my twenty first birthday,” he stated, and stated that FTX didn’t have wild events, and that if there have been events, staff performed board video games.

The DealBook Summit is a self-described area for “unguarded conversations about enterprise, tradition, and politics.” It’s arrange as an elite gathering of individuals with the affect to form the worlds of finance, enterprise, and politics; an everyday ticket has a $2,499 price ticket. Among the many panoply of well-known names in attendance this 12 months had been Netflix CEO Reed Hastings, Amazon CEO Andy Jassy, Meta CEO Mark Zuckerberg, and Ukrainian President Volodymyr Zelenskyy.

It has usually been a pleasant stage for enterprise leaders, and previous interviewees embrace Elon Musk in addition to enterprise capitalist and Republican megadonor Peter Thiel, Apple CEO Tim Prepare dinner, Twitter co-founder Jack Dorsey, and Microsoft co-founder and philanthropist Invoice Gates. Final 12 months’s digital summit, nonetheless, invited disgraced WeWork founder Adam Neumann for his first interview about two years after the company scandal that tarnished his repute.

Not like Neumann, Bankman-Fried didn’t wait two years after his public immolation to do an interview, and it appears he isn’t loath to draw extra consideration. Since FTX’s collapse, and since allegations of fraud surfaced just a few weeks in the past, Bankman-Fried has been uncommonly talkative on Twitter and with journalists. He was bewilderingly candid in a Twitter DM interview with Vox journalist Kelsey Piper, pulling again the curtain on the form of reputation-polishing that, as Bankman-Fried implies, all highly effective individuals — together with himself — interact in. In his DMs, the masks of his picture as a considerate philanthropist and diplomatic crypto spokesperson slipped; he stated bluntly, on the problem of crypto regulation, “fuck regulators” and espoused the view that the world cared extra about who they perceived as “winners” than individuals who had been really moral.

Bankman-Fried tried to make clear and soften a number of the feedback in that interview on the DealBook Summit, saying that he genuinely cared about necessary points similar to animal welfare and pandemic prevention. However he stood agency on the concept “doing good” was usually a PR recreation that firms performed. “There’s a bunch of bullshit that regulated firms do,” he stated. “It’s only a PR marketing campaign masquerading as do-gooderism.” He acknowledged that he, too, had participated in such PR campaigns. “Yeah. All of us did.”

After Bankman-Fried’s Vox interview, the present CEO of FTX, John Ray III (who helped restructure Enron when it went bankrupt), launched a terse reminder on Twitter that Bankman-Fried now not spoke on behalf of the corporate. On Wednesday, nonetheless, Bankman-Fried had a lot to say about FTX. Sorkin pressed him on the specifics of what had occurred and what he had recognized, asking him early about whether or not there had been a commingling of funds between FTX and the buying and selling agency Bankman-Fried had based, Alameda Analysis. Alameda has been accused of borrowing FTX clients’ funds. “I didn’t knowingly commingle funds,” Bankman-Fried replied. He stated he realized belatedly that FTX shopper cash and Alameda cash had been tied collectively “considerably extra” than he would have wished it to be.

As Bankman-Fried continued to repeat that he hadn’t been conscious of the true financials of each firms, Sorkin was blunt: “However, Sam, I feel the query is whether or not you had been imagined to have entry to those [customer] accounts to start with.”

Bankman-Fried averted that query, insisting once more that he had little involvement in Alameda.

Bankman-Fried’s presence on the summit raised quite a few questions: Does listening to from a disgraced enterprise chief on such a big stage assist the general public get nearer to the reality about what occurred? Or does it hand again some management to a robust particular person, permitting them to prune their public picture and inject an exculpatory spin on the unfolding narrative of FTX and of Bankman-Fried himself?

When requested whether or not he had been sincere through the interview, Bankman-Fried’s reply was an ideal encapsulation of the vagueness and word-twisting he’d displayed through the interview. “I used to be as truthful as, , I’m educated to be,” he stated. After which, as if he was pondering higher of the hedging, he added: “Sure, I used to be.”

Assist maintain articles like this free

Understanding America’s political sphere will be overwhelming. That’s the place Vox is available in. We purpose to provide research-driven, sensible, and accessible info to everybody who needs it.Reader presents help this mission by serving to to maintain our work free — whether or not we’re including nuanced context to sudden occasions or explaining how our democracy received up to now. Whereas we’re dedicated to maintaining Vox free, our distinctive model of explanatory journalism does take lots of assets. Promoting alone isn’t sufficient to help it. Assist maintain work like this free for all by making a present to Vox in the present day.

Sure, I will give $120/12 months

Sure, I will give $120/12 months

We settle for bank card, Apple Pay, and

Google Pay. You can even contribute by way of

[ad_2]