[ad_1]

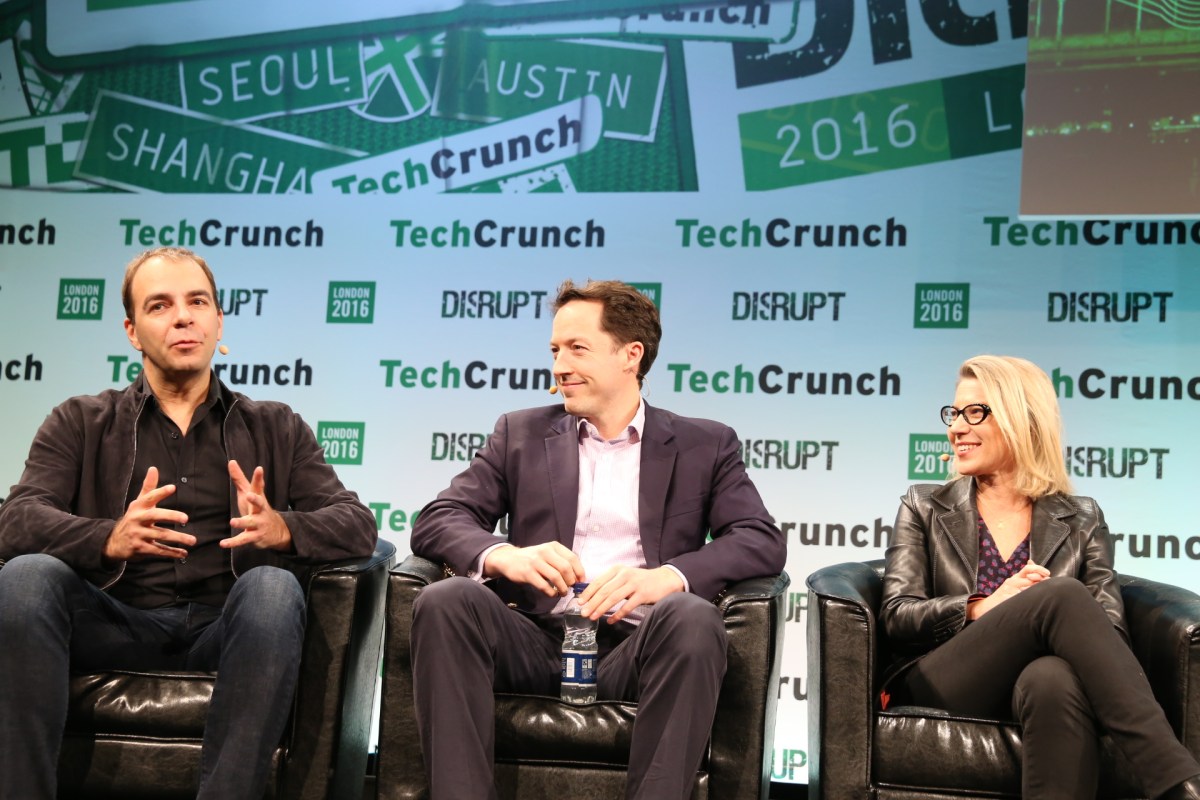

Yesterday, we had the possibility to meet up with Fabrice Grinda, a serial entrepreneur who co-founded the free classifieds web site OLX — now owned by Prosus — and who has in recent times been increase his enterprise agency, FJ Labs. He typically likens the outfit to an angel investor “at scale,” saying that like plenty of angel buyers, “We don’t lead, we don’t value, we don’t take board seats. We determine after two one-hour conferences over the course of every week whether or not we make investments or not.”

The outfit, which Grinda co-founded with entrepreneur Jose Marin, has definitely been busy. Although its debut fund was comparatively small — it raised $50 million from a single restricted accomplice in 2016 — Grinda says that FJ Labs is now backed by a big selection of buyers and has invested in 900 corporations around the globe by writing them checks of between $250,000 and $500,000 for a stake of usually 1% to three% in every.

In actual fact, the information supplier PitchBook not too long ago ranked FJ Labs probably the most lively enterprise outfit globally, simply forward of the worldwide outfit SOSV. (You’ll be able to see Pitchbook’s rankings at web page backside.)

Yesterday, Grinda instructed that the agency may grow to be much more lively in 2023, now that the market has cooled and founders are extra keen on FJ Lab’s largest promise to them — that it get them follow-on funding come hell or excessive water via the connections of Grinda and his companions. Certainly, whereas that promise was most likely much less attention-grabbing in a world awash with capital, it has doubtless grow to be extra compelling as buyers pull again and founders discover themselves going through fewer choices. Excerpts from our wide-ranging chat with Grinda comply with, edited frivolously for size.

TC: You’re making so many bets in alternate for a really small stake. In the meantime you’ve guess on corporations like Flexport which have raised some huge cash. You’re not getting washed out of those offers as they increase spherical after spherical from different buyers?

FC: It’s true that you simply typically go from 2% to 1% to 0.5%. However so long as an organization exits at 100 occasions that worth, say we put in $250,000 and it turns into $20 million, that’s completely positive. It doesn’t hassle me if we get diluted on the best way up.

When making as many bets as FJ Labs does, conflicts of curiosity appear inevitable. What’s your coverage on funding corporations that may compete with each other?

We keep away from investing in opponents. Generally we guess on the precise or the unsuitable horse and it’s okay. We made our guess. The one case the place it does occur is that if we put money into two corporations that aren’t aggressive which can be doing various things, however considered one of them pivots into the market of the opposite. However in any other case we now have a really Chinese language Wall coverage. We don’t share any knowledge from one firm to the others, not even abstracted.

We’ll put money into the identical thought in numerous geographies, however we’ll clear it by the founder first as a result of, to your level, there are a lot of corporations that entice the identical markets. In actual fact, we could not take a name when an organization is within the pre-seed or seed-stage and even A stage if there are seven corporations doing the identical factor. We’re like, ‘You already know what? We’re not snug making the guess now, as a result of if we make a guess now, it’s our horse within the race endlessly.’

You talked about not having or wanting board seats. Given what we’re seen at FTX and different startups that don’t seem to have sufficient skilled VCs concerned, why is that this your coverage?

Initially, I believe most individuals are good-intentioned and reliable so I don’t concentrate on defending the draw back. The draw back is that an organization goes to zero and the upside is that it goes to 100 or 1,000 and pays for the losses. Are there instances the place there was fraud in lining the numbers? Sure, however would I’ve recognized it if I sat on the board? I believe the reply isn’t any, as a result of VCs do depend on numbers given to them by the founder and what if somebody’s supplying you with numbers which can be unsuitable? It’s not as if the board members of those corporations would establish it.

My alternative to not be on boards is definitely additionally a mirrored image of my private historical past. Once I was working board conferences as a founder, I did really feel they have been a helpful reporting perform, however I didn’t really feel they have been probably the most attention-grabbing strategic conversations. Lots of the most attention-grabbing conversations occurred with different VCs or founders who had nothing to do with my firm. So our method is that when you as a founder need recommendation or suggestions, we’re there for you, although you want to attain out. I discover that results in extra attention-grabbing and trustworthy conversations than while you’re in a proper board assembly, which feels stifled.

The market has modified, plenty of late-stage funding has dried up. How lively would you say a few of these identical buyers are in earlier-stage offers?

They’re writing some checks, however not very many checks. Both means, it’s not aggressive with [FJ Labs] as a result of these guys are writing a $7 million or a $10 million Collection A test. The median seed [round] we see is $3 million at a pre-money valuation of $9 million and $12 million submit [money valuation], and we’re writing $250,000 checks as a part of that. When you’ve gotten a $1 billion or $2 billion fund, you aren’t going to be taking part in in that pool. It’s too many offers you’d have to do to deploy that capital.

Are you lastly seeing an influence on seed-stage sizes and valuations owing to the broader downturn? It clearly hit the later-stage corporations a lot sooner.

We’re seeing plenty of corporations that will have appreciated to lift a subsequent spherical — which have the traction that will have simply justified a brand new exterior spherical a 12 months or two or three years in the past — having to as a substitute increase a flat, inner spherical as an extension to their final spherical. We simply invested in an organization’s A3 spherical — so three extensions on the identical value. Generally we give these corporations a ten% or 15% or 20% bump to replicate the truth that they’ve grown. However these startups have grown 3x, 4x, 5x since their final spherical and they’re nonetheless elevating flat, so there was huge multiples compression.

What about fatality charges? So many corporations raised cash at overly wealthy valuations final 12 months and the 12 months earlier than. What are you seeing in your personal portfolio?

Traditionally, we’ve made cash on about 50% of the offers we’ve invested in, which quantities to 300 exits and we’ve made cash as a result of we’ve been value delicate. However fatality is rising. We’re seeing plenty of ‘acqui-hires,’ and firms perhaps promoting for much less cash than was raised. However most of the corporations nonetheless have money till subsequent 12 months, and so I think that the actual wave of fatalities will arrive in the midst of subsequent 12 months. The exercise we’re seeing proper now could be consolidation, and it’s the weaker gamers in our portfolio which can be being acquired. I noticed one this morning the place we obtained like 88% again, one other that delivered 68%, and one other the place we obtained between 1 and 1.5x of our a reimbursement. In order that wave is coming, but it surely’s six to 9 months away.

How do you’re feeling about debt? I typically fear about founders getting in over their heads, considering it’s comparatively protected cash.

Usually startups don’t [secure] debt till their A and B rounds, so the problem is normally not the enterprise debt. The difficulty is extra the credit score traces, which, relying on the enterprise you’re in, you need to completely use. For those who’re a lender as an example and also you do factoring, you’re not going to be lending off the stability sheet. That’s not scalable. As you develop your mortgage e-book, you would want infinite fairness capital, which might delete you to zero. What normally occurs when you’re a lending enterprise is you initially lend off the stability sheet, then you definately get some household places of work, some hedge funds, and ultimately a financial institution line of credit score, and it will get cheaper and cheaper and scales.

The difficulty is in a rising-rate surroundings, and an surroundings the place maybe the underlying credit score scores — the fashions that you simply use — usually are not as excessive and never as profitable as you’d assume. These traces get pulled, and your enterprise will be in danger [as a result]. So I believe plenty of the fintech corporations which can be depending on these credit score traces could also be going through an existential danger consequently. It’s not as a result of they took on extra debt; it’s as a result of the credit score traces they used is perhaps revoked.

In the meantime, inventory-based companies [could also be in trouble]. With a direct-to-consumer enterprise, once more, you don’t wish to be utilizing fairness to purchase stock, so you employ credit score, and that is smart. So long as you’ve gotten a viable enterprise mannequin, folks will provide you with debt to finance your stock. However once more, the price of that debt goes up as a result of the rates of interest are going up. And since the underwriters have gotten extra cautious, they could lower your line, wherein case your means to develop is mainly shrinking. So corporations that rely on that to develop shortly are going to see themselves extraordinarily constrained and are going to have a tough time on a go-forward foundation.

Picture Credit: PitchBook

[ad_2]