[ad_1]

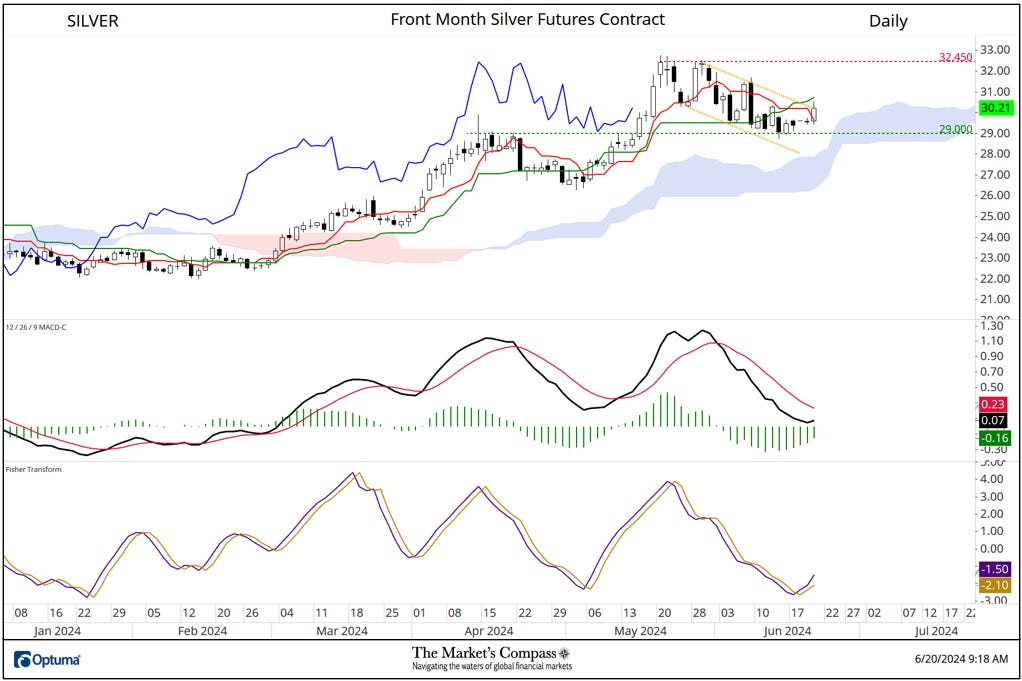

It could be untimely to declare the three-week corrective part in Silver has run its course by there are early indicators that it could have reached its terminus. Key help on the $29 held final week and early this week and costs have began to maneuver larger and are difficult the down development line (yellow dotted line). Costs additionally prevented a take a look at of Cloud help. What I think about because the “first mover”, Fisher Rework has began to hook larger, from an excessive low and has overtaken its sign line. MACD has so far prevented getting into adverse territory and is stabilizing in live performance with the histogram* (vertical inexperienced strains) pushing larger. Key to the thesis that the short-term correction is full is Silver’s capability to shut above downtrend resistance and its capability to overhaul and shut above the Kijun Span which is the midpoint between the best excessive and lowest low over previous 26 buying and selling classes. I could also be sticking my neck out, however I imagine odds favor that the three-week corrective part has certainly run its course.*The MACD histogram is the distinction between MACD and its sign lineFor readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of Silver can avail themselves of a short tutorial titled, Instruments of Technical Evaluation that’s posted on The Markets Compass web site…https://themarketscompass.comCharts are courtesy of Optuma.To obtain a 30-day trial of Optuma charting software program go to…www.optuma.com/TMC

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.