[ad_1]

Micro and small companies in rising markets nonetheless wrestle to entry on-line funds for a number of causes. One, most of them are excluded from varied cost ecosystems globally as a consequence of their dimension, and two, getting {hardware} from suppliers may be costly.

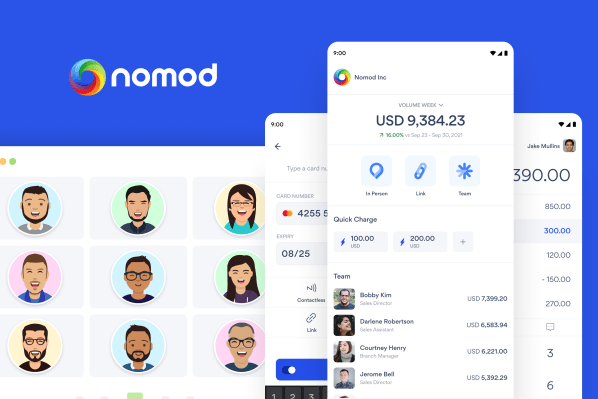

U.Ok.-based fintech Nomod permits these companies to bypass the cardboard terminal by offering a platform to just accept card funds on their telephone with no additional {hardware}. The corporate has raised $3.4 million in seed funding at a valuation of $50 million.

Funds will act as the corporate’s flywheel to accumulate a service provider base and construct out a monetary working system, founder and CEO Omar Kassim informed TechCrunch.

The plan for the corporate is to supply retailers with entry to accounts, playing cards, native cost networks and lending. This suite of companies is crucial within the major markets by which Nomod has a major service provider base, like Saudi Arabia, the UAE and Bangladesh.

In Saudi Arabia, as an example, solely 3% of greater than 1 million registered companies have entry to financial institution credit score. Within the UAE, it may take almost six months to arrange a enterprise checking account. For Bangladesh, card POS {hardware} is fairly costly for small and medium retailers.

With Nomod, retailers can begin coping with funds points first as they’ll obtain Nomod on their telephones and course of in-person funds and cost hyperlinks from prospects.

Prospects can use totally different playing cards, from Visa and Mastercard to American Categorical and Union Pay, or go contactless by way of NFC and QR codes. The corporate additionally permits retailers to cost in over 135 currencies.

“A service provider at present can set up Nomod, enroll in three or 4 minutes and begin processing in-person and on-line funds utilizing cost hyperlinks,” Kassim mentioned in a name with TechCrunch.

Omar Kassim (Nomod CEO)

Though Nomod has most of its retailers within the MENA and GCC area, Kassim says the platform has a worldwide attain and permits retailers to enroll from greater than 40 nations throughout Europe, the U.S., Australia, Africa and Asia.

Kassim mentioned the corporate is conducting exams with retailers in Nigeria and South Africa and expects to launch each markets shortly.

“Our thesis is that card acceptance is a reasonably homogenous motion. Whether or not you’re doing it in Australia or India, or wherever, it doesn’t actually matter. We really feel like we will do quite a lot of markets in parallel, and at present, we permit retailers to enroll from 44 totally different nations to make use of our platform.”

For now, Nomod can purchase and settle retailers within the U.S., the U.Ok and the UAE of their native currencies — {dollars}, kilos and dirhams, respectively.

However in different markets the place there’s some foreign money fluctuation, say, in South Africa, Nomod applies some FX value, thereby altering currencies. Kassim says that when there’s vital adoption in such markets, Nomod will optimize its platform for the retailers and start buying and providing settlements of their native currencies.

From its YC bio, Nomod describes itself as “Sq. minus the {hardware}” and Kassim believes the title is telling, significantly as to how funds have advanced since Stripe launched in 2010.

In response to the founder, if the $95 billion firm have been to launch newly, it will not want {hardware}. Nonetheless, his bias outcomes from how funds work in rising markets just like the UAE, the place most companies perform their fintech transactions utilizing wallets or tokens. The platform is certainly one of Stripe’s listed companions to just accept in-person funds.

“Some platforms are seeing about 60-70% of all of their on-line transactions coming from Apple Pay. And so what you’re discovering is that buyers as of late actively tokenizing [payments] onto their system.”

Earlier than Nomod, Kassim ran an e-commerce market platform JadoPado and bought it to Midday, an Amazon competitor within the MENA area.

He then labored on some consulting gigs, and after noticing the wave of fintech and neobank exercise that stormed the U.Ok., he began Nomod as a aspect challenge in 2018. It was a easy app that allowed anybody with a Stripe account to make in-person funds.

Operating the product gave him two broad concepts on how he thought funds would possibly look sooner or later. First was that plastic playing cards get changed by digital tokens or native wallets in client fintech. And for fintechs concentrating on retailers, legacy {hardware} would give strategy to software-led options.

“There isn’t a dominant cellular software program resolution for funds globally for the time being. So I virtually really feel like there’s a chance for us to construct like a WhatsApp or Telegram equal for cost acceptance or head to head as properly with issues like cost hyperlinks and subscription.”

Since formally launching in March 2021, Nomod has acquired almost 4,500 retailers. In response to the corporate, its complete processed quantity has grown 11.5x and is on an annualized run charge of $7 million.

The corporate, which graduated from the latest Y Combinator summer season batch, obtained investments led by World Founders Capital. Different VCs corresponding to Kingsway Capital, Goodwater Capital, and angels from the Valley and globally, together with a companion from DST World, participated.

[ad_2]