[ad_1]

Andy Stinnes, normal companion at Cloud Apps Capital Companions, leads early-stage investments in cloud companies and serves as energetic board member and adviser, providing operational help for portfolio firms primarily based on his 20+ years in govt roles in enterprise software program.

Extra posts by this contributor

Seed will not be the brand new Sequence A

It appears there’s information day by day about startup funding reaching document highs, new unicorns being minted and tech companies going public. There’s no query that we’re in the course of a long-running and accelerating enterprise bull market.

All of this impresses upon us that each indicator in startup funding factors up and to the correct: Enterprise companies have extra dry powder, deal sizes are rising quickly, valuations are hovering and funding phrases are extra founder-friendly than ever. And all that’s certainly occurring.

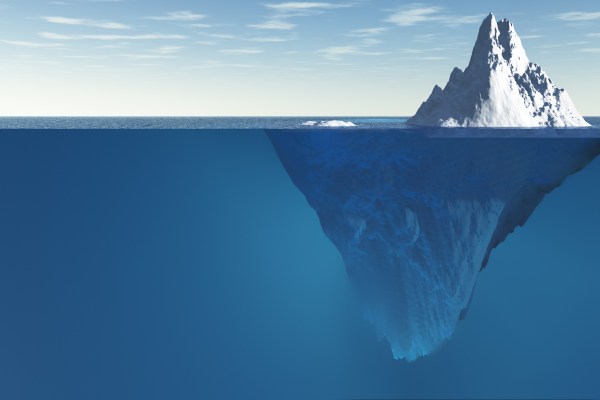

However a better inspection reveals that these traits are much more nuanced and apply very unequally throughout the funding continuum from seed to the late stage. What’s extra, many of the underlying truths and guidelines aren’t altering.

The enterprise alphabet soup of “A, B, C rounds” suggests it’s all the identical, only one after the opposite, however it’s not. It’s extra like taking part in a wholly completely different sport.

Watch out for the outliers

The stage definitions in enterprise, from seed to late-stage Sequence D, E or F rounds, have all the time been open to interpretation, and normal patterns are challenged by outliers at every stage. Outliers — unusually giant financings with excessive valuations relative to the corporate’s maturity — are as previous because the trade itself. However nowadays, there are extra of them, and the outliers are extra excessive than ever earlier than.

For instance, Databricks raised two huge personal rounds, a $1 billion Sequence G and a $1.6 billion Sequence H, in 2021. These funding rounds are greater than many IPOs within the current previous, and Databricks is way from the one firm to do one thing like this. There have been a mean of 35 “megadeals” (with over $100 million raised) per 30 days from 2016 to 2019, in response to Crunchbase. In 2021, that quantity stands at 126 per 30 days.

That is primarily attributable to two main traits. First, the extraordinarily profitable exit market has created the economics to help mega late-stage rounds and enterprise rounds of $100 million or extra. And, firms are staying personal longer, they usually want extra late-stage capital earlier than an IPO that firms traditionally didn’t want. Extra on that beneath.

What’s necessary for now’s to acknowledge the straightforward fact that aggregates and averages don’t inform the actual story of the broader market. The median of funding spherical sizes and valuations give a greater view of how the market is admittedly doing. So while you see the following report on a document enterprise funding month, pay shut consideration to what’s being heralded.

Phases behave very in a different way

Most individuals suppose the substantial development applies throughout the funding continuum, however that isn’t actually the case. In truth, the enterprise bull market impacts completely different phases very in a different way. The next relies on Cloud Apps Capital Companions’ evaluation of PitchBook information on totally documented U.S. financings (seed by way of Sequence D) within the cloud enterprise software area since 2018 by way of the primary half of 2021.

The most important influence seems to be within the late stage. For Sequence C and D financings as a gaggle, median spherical sizes greater than doubled to $63 million in 2021 from $31 million in 2018. Pre-money valuations grew by 151%, and possession — the share fairness traders within the spherical collectively personal after the financing — dropped to 12% from 18%. So the cash concerned has doubled, however Sequence C and D traders ended up proudly owning a 3rd lower than they used to.

[ad_2]