[ad_1]

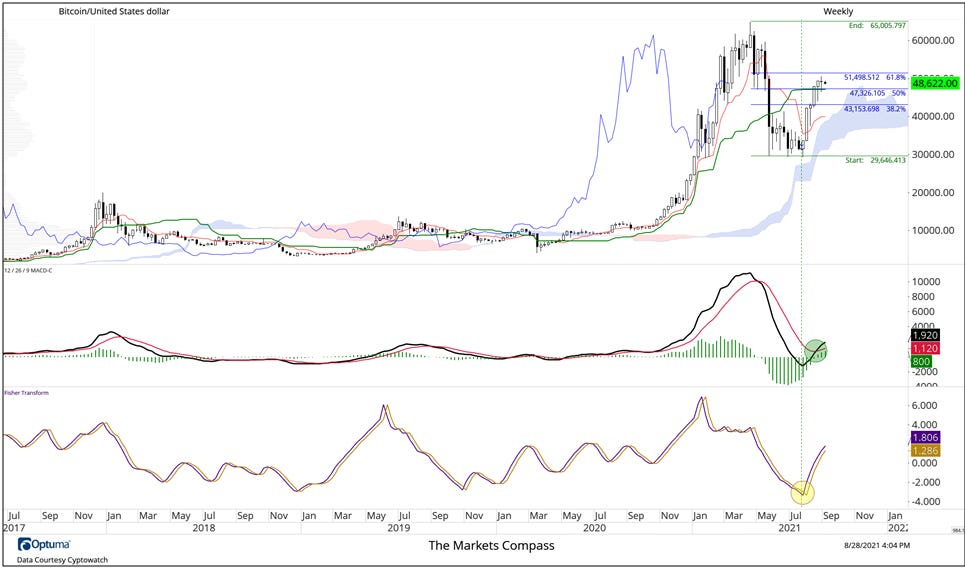

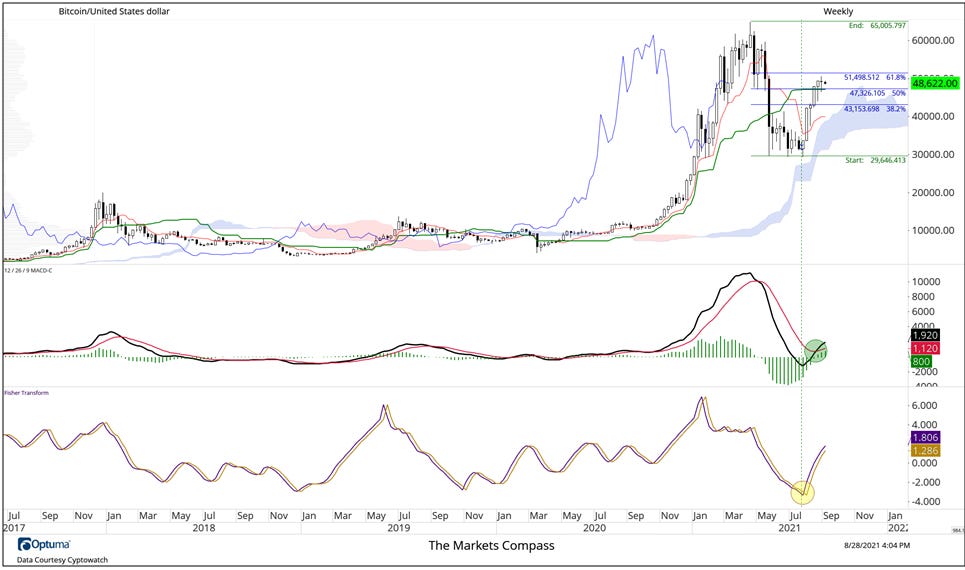

SummaryAs our common tweets have said, Bitcoin had rallied over $21,000 for the reason that July low into an space of overhead provide that led us to our brief time period goal of between 50,000 and 51,300. We’ve got referred to that provide because the “spring time bag holders” who’re comfortable to at this level to get out with much less of a loss than in the event that they bought on the lows. That stated, we’re positive a lot of buyers have been shaken out of their positions in late July. After the month lengthy rally into the aforementioned space of provide we aren’t stunned to see a interval of consolidation or value retracement. We proceed to consider that though minor help on the Kijun Span (44,000) will supply a measure of brief time period help, 42,300 seems to be extra possible the draw back goal for this pull again. What follows is a multi-time body evaluation that leads us to this technical thesis.

a.image2.image-link.image2-570-965 {

padding-bottom: 59.067357512953365%;

padding-bottom: min(59.067357512953365%, 570px);

width: 100%;

top: 0;

}

a.image2.image-link.image2-570-965 img {

max-width: 965px;

max-height: 570px;

}

Weekly Time FrameThe chart above displays the long term value motion that gave us confidence that on the very least a major low had occurred. Though in late July we have been involved that if sellers hold their shoulder on the door of help in would give approach the triple backside held. Over the last week of July Bitcoin rallied sharply and there was a pointy reversal of down facet momentum at witnessed by the flip within the Fisher Rework (yellow circle) which was adopted by a flip in MACD (inexperienced circle) again into constructive territory above its sign line (please see our multi-chapter Technical Tutorial on MACD for these interested by studying the appliance of the momentum indicator). Bitcoin’s skill to certain first via potential resistance at 38.2% retracement stage after a quick relaxation and thru the 50% retracement stage provides us confidence that the all-time highs can be challenged.

a.image2.image-link.image2-569-954 {

padding-bottom: 59.64360587002096%;

padding-bottom: min(59.64360587002096%, 569px);

width: 100%;

top: 0;

}

a.image2.image-link.image2-569-954 img {

max-width: 954px;

max-height: 569px;

}

Every day Time FrameThe day by day chart reveals in far more element why we thought of after the month lengthy advance why Bitcoin would possible stall on the 50,000 to 51,300 stage. One of the crucial misused declared technical phrases in technical evaluation is a “head and shoulders” value sample however the interval between February and the center of Might was nonetheless a interval of distribution no matter moniker one makes use of. Buyers who have been shopping for throughout that interval and weren’t a part of the group promoting have been what we confer with because the “spring time bag holders”. These consumers are possible nonetheless licking their wounds in the event that they weren’t shaken out on the lows. It no shock that the advance off of the lows has stalled as they are often heard saying “let me get out with a smaller loss”.When the brief time period excessive at our goal stage and costs started to show decrease we added the Customary Pitchfork (crimson P1 via P3). Up to now the Median Line has held as help (crimson dotted line) and costs stay within the higher channel. That stated we anticipate that extra time and a doubtlessly deeper value pullback could also be wanted earlier than the assault on the band of value resistance and ultimately the all-time highs resumes. We now mark brief time period help on the Kijun Span (44,000) and second at Fibonacci 38.2% retracement stage (42,300).

a.image2.image-link.image2-572-958 {

padding-bottom: 59.707724425887264%;

padding-bottom: min(59.707724425887264%, 572px);

width: 100%;

top: 0;

}

a.image2.image-link.image2-572-958 img {

max-width: 958px;

max-height: 572px;

}

240-Minute Time FrameWhen costs reached our goal stage and turned decrease we added the Schiff Modified Pitchfork (gold P1 via P3). The pullback from the latest highs slowed yesterday on the Decrease Parallel of the Pitchfork and Bitcoin has rallied however has stalled on the Median Line (gold dotted line). On the very least the worth motion since we selected the Schiff Modified model of Andrews Pitchfork was appropriate because it marks the worth and time vector. It is also monitoring the angle of the Clouds assent. If help on the Decrease Parallel of the Pitchfork is violated a take a look at of brief time period TDST help at 44,165 is probably going within the playing cards.Assets and LearningTo study extra concerning the instruments I exploit to develop my technical theses in crypto currencies and different monetary markets, comply with the hyperlink under for a quick tutorial. The tutorial is titled “Instruments of Technical Evaluation”.https://www.themarketscompass.comFollow the hyperlink under for an unique 30-day free trial of Optuma’s Charting Software program:https://www.optuma.com/TMC

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.