[ad_1]

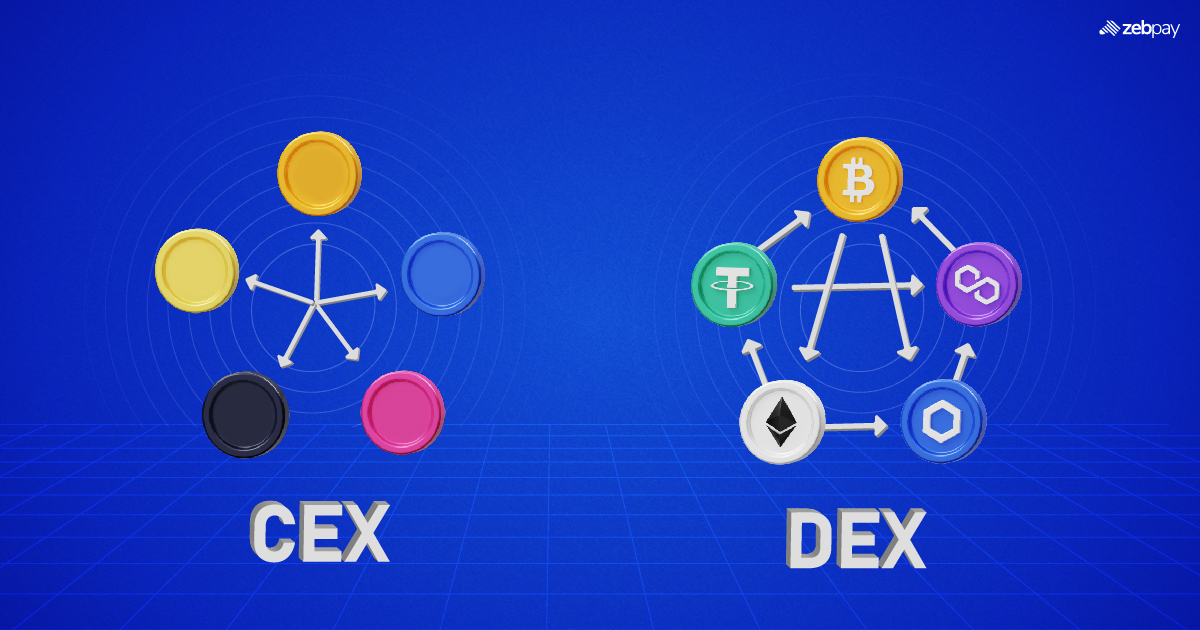

Crypto buying and selling is gaining reputation on daily basis, with the potential of excessive returns on the tip of your fingers. To get began, all you want is a crypto alternate to commerce your funds. However with so many choices out there, how do you make the only option? This text will break down the variations between centralised and decentralised crypto exchanges, so you can also make the proper selection in your wants.

What’s a Centralized Change (CEX)?

A centralized alternate is a platform the place all transactions are managed by a government, and customers deposit their funds into the alternate’s centralised pockets. The sort of alternate operates like a conventional inventory alternate, the place a 3rd social gathering manages the trades and retains custody of the property.

Benefits of CEX

One of many vital benefits of CEXs is their user-friendly interface, making them accessible even to new merchants. Moreover, CEXs provide quicker transaction occasions, larger liquidity and a variety of buying and selling pairs. These exchanges even have strong buyer help, making them extra accessible to rookies who would possibly need assistance navigating the buying and selling course of.

Disadvantages of CEX

Nonetheless, centralised exchanges even have few disadvantages. Firstly, CEXs are susceptible to hacks and thefts since they maintain customers’ funds in a central location. Secondly, they’re typically subjected to strict laws and authorities interventions, resulting in potential downtime or restrictions.

What’s a Decentralized Change (DEX)?

A decentralized alternate is a platform the place customers can commerce crypto instantly with out the necessity for an middleman or central authority. These exchanges are primarily based on blockchain expertise, enabling peer-to-peer transactions, and are sometimes powered by good contracts.

Benefits of DEX

One of many vital benefits of DEXs is their excessive degree of safety since consumer funds usually are not saved in a centralised location. They’re as an alternative distributed throughout the blockchain, making them extra resilient to hacks and thefts. Moreover, DEXs provide customers better privateness since they don’t require KYC checks or private data to commerce. Lastly, DEXs are extra decentralised and fewer prone to authorities interventions or shutdowns.

Disadvantages of DEX

Nonetheless, DEXs are nonetheless comparatively new and have a number of disadvantages. Firstly, they aren’t as user-friendly as CEXs, making them tougher for rookies to make use of. Secondly, DEXs typically have decrease liquidity since they depend on customers to offer liquidity by good contracts. Lastly, transaction occasions on DEXs could be slower, resulting in potential delays and better transaction charges.

CEX vs DEX: A Comparability

Right here is an easy CEX vs DEX comparability that breaks down their primary options.

FactorsCEXDEXCentralizationCentralisedDecentralisedPrivacyKYC/AML requiredAnonymous tradingSecurityCentralised, extra vulnerable to hacksDecentralised, much less vulnerable to hacksLiquidityHigh liquidityLower liquidityFeesHigher feesLower feesSpeedFaster transaction timesSlower transaction timesUser ExperienceUser-friendly interfaceComplex. Requires interplay with good contractsTradingBuying and promoting facilitated by the exchangePeer-to-peer tradingRegulatory FrameworkSubject to regulation and licensingNot at all times regulated or licensed

CEX vs DEX for Safety

CEXs are usually thought of much less safe than DEXs since they’re centralised and maintain customers’ funds in a central location. CEXs are sometimes focused by hackers, resulting in theft and losses for customers. In distinction, DEXs provide better safety since they don’t retailer consumer funds in a central location, decreasing the danger of hacks and thefts. Nonetheless, that is additionally topic to which centralised alternate we’re bearing in mind. For instance: ZebPay has state-of-the-art safety and has by no means been hacked until date. Our strong safety methods hold buyer property secure always.

CEX vs DEX for Liquidity

CEXs provide larger liquidity since they’ve extra buying and selling pairs, making it simpler to purchase and promote crypto property. Moreover, CEXs typically provide margin buying and selling, additional growing liquidity. DEXs, however, have decrease liquidity since they depend on customers to offer liquidity by good contracts.

CEX vs DEX for Charges

CEXs typically cost larger charges than DEXs, with charges starting from 0.1% to 0.5% per commerce. Moreover, CEXs could cost extra charges for depositing, withdrawing, or buying and selling sure currencies. In distinction, DEXs typically have decrease charges, with some platforms providing zero buying and selling charges, however they could cost community charges for transactions. Within the CEX vs DEX for charges comparability, DEXs come out forward.

CEX vs DEX for Person Expertise

CEXs are usually thought of extra user-friendly than DEXs since they’ve a easy and intuitive consumer interface. CEXs typically provide a spread of instruments and options, making it simpler for customers to purchase and promote crypto. DEXs, however, are extra complicated and require customers to work together with good contracts.

Which is Higher: CEX or DEX?

The reply to this query will depend on a number of elements, such because the consumer’s buying and selling expertise, choice for privateness, and safety issues. In the event you’re a brand new dealer, a CEX could be a greater possibility because it’s extra user-friendly and affords larger liquidity.

One other issue to think about is transaction charges, the place DEXs typically have decrease charges than CEXs. Nonetheless, this isn’t at all times the case, and a few DEXs might need larger community charges, making it costlier to commerce crypto.

Lastly, in terms of velocity and transaction occasions, CEXs are usually quicker than DEXs. It’s because CEXs have a centralised system, which permits quicker transactions, whereas DEXs are decentralized, which can lead to slower transaction occasions.

Learn extra: Crypto Buying and selling Methods

Conclusion: Selecting the Proper Change

In conclusion, selecting between a CEX or a DEX will depend on your buying and selling wants and preferences. In the event you’re a brand new dealer, a CEX could be a greater possibility as a result of its ease of use and better liquidity. Nonetheless, when you’re involved about privateness, a DEX could be a greater possibility because it’s extra decentralized and affords better privateness.

It’s important to think about the elements mentioned on this article, resembling safety, liquidity, charges, consumer expertise, and velocity when selecting an alternate. Finally, you need to select an alternate that most closely fits your buying and selling wants and gives the required options and instruments for a seamless buying and selling expertise.

You’ll be able to learn extra about Internet 3.0, What’s DEX and blockchain on ZebPay blogs. Be a part of the thousands and thousands already utilizing ZebPay.

FAQs on CEX vs DEX

What Is The Distinction Between A Cex And A Dex?

A CEX is centralised, which signifies that it’s managed by a government that manages the alternate’s operations. In distinction, a DEX is decentralized, working on a decentralized platform that doesn’t depend on a government.

What are Among the Finest CEX and DEX Platforms?

Among the greatest CEX platforms are Coinbase, Binance and ZebPay, whereas some in style DEX platforms embrace Uniswap, PancakeSwap and SushiSwap. It’s necessary to do your analysis and examine totally different exchanges earlier than selecting one to commerce on.

Do I Want To Present Private Info To Commerce On A Dex?

No, DEXs typically enable customers to commerce anonymously with out the necessity for KYC or AML checks. It’s because they’re decentralized and don’t require a government to handle consumer accounts.

Which is healthier for a brand new dealer, a CEX or a DEX?

CEXs are usually thought of extra user-friendly than DEXs, making them a greater possibility for brand new merchants. Moreover, CEXs typically have larger liquidity, making it simpler for merchants to purchase or promote crypto tokens.

Disclaimer: Crypto merchandise and NFTs are unregulated and could be extremely dangerous. There could also be no regulatory recourse for any loss from such transactions. Every investor should do his/her personal analysis or search impartial recommendation if crucial earlier than initiating any transactions in crypto merchandise and NFTs. The views, ideas, and opinions expressed within the article belong solely to the writer, and to not ZebPay or the writer’s employer or different teams or people. ZebPay shall not be held answerable for any acts or omissions, or losses incurred by the buyers. ZebPay has not obtained any compensation in money or variety for the above article and the article is offered “as is”, with no assure of completeness, accuracy, timeliness or of the outcomes obtained from using this data.

[ad_2]