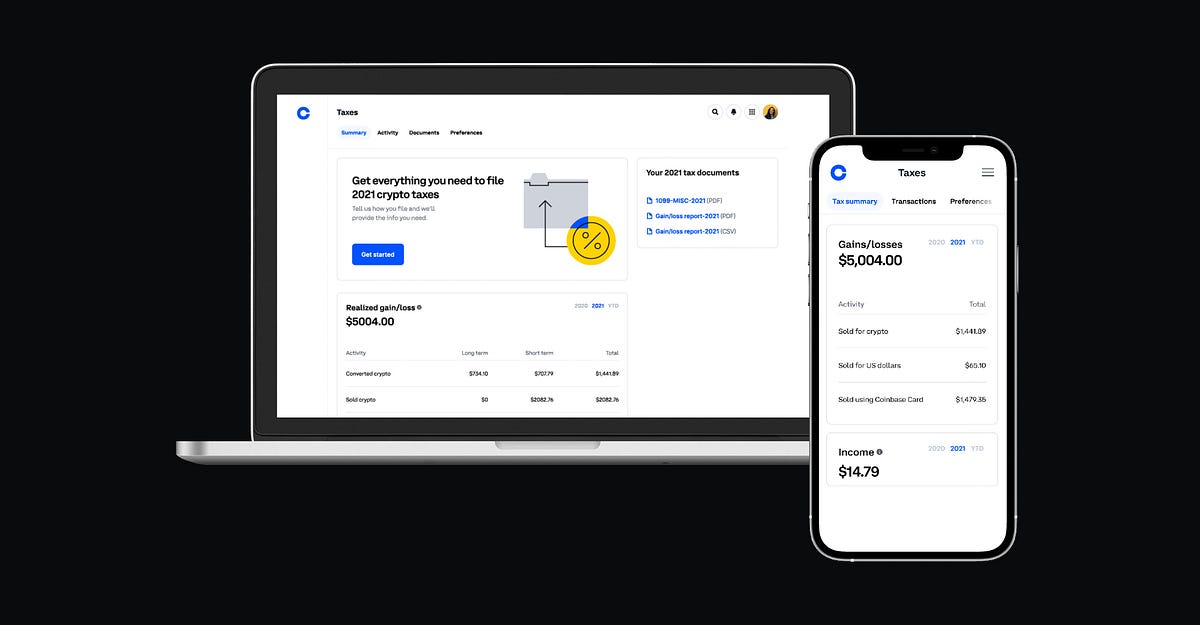

By Lucy Aziz, Product Supervisor, CoinbaseCrypto taxes will be difficult. Final tax season, many shoppers informed us they didn’t know in the event that they owed taxes on their crypto exercise, and people who did know discovered it handbook and tough to file.This tax season, we’re introducing a tax middle so clients can perceive and file their crypto taxes with extra ease and confidence. Clients will see all of their taxable exercise in a single place to find out in the event that they owe taxes, and the way a lot. In the event that they’ve taken extra superior steps like sending or receiving crypto from Coinbase Professional or exterior wallets, they’ll obtain free tax reviews for as much as 3,000 transactions from our crypto tax companion CoinTracker. Essentially the most difficult time of the 12 months simply turned extra clear.See a easy abstract of taxable amountsU.S. taxpayers are required to report crypto gross sales, conversions, funds, and revenue to the IRS, and these transactions could also be taxed as both capital features/ losses or as common revenue. Final 12 months, clients needed to analysis which transactions had been thought-about taxable, after which manually observe and kind them to calculate their features/losses. It was tedious and time-consuming.Now, we’re simplifying the method by displaying every buyer a customized abstract of their taxable exercise on Coinbase, damaged out over time by realized features/losses and miscellaneous revenue. Clients can use these quantities to organize and file their taxes both with their private accountants or instantly with tax prep software program like TurboTax®, the place all Coinbase clients stand up to $20 off TurboTax merchandise.Get assist with all crypto taxes, even transactions off CoinbaseU.S. taxpayers might owe taxes on the quantity they gained from crypto, or might be able to use losses in opposition to their different revenue. In an effort to calculate features/losses, we have to know the preliminary worth of a buyer’s crypto. There are some instances the place Coinbase is lacking this info (e.g. the shopper obtained it from an exterior pockets). Clients with these instances can use our crypto tax companion CoinTracker to mixture their transactions throughout Coinbase and different exchanges, wallets, and DeFi providers. Coinbase and Coinbase Professional clients have free entry to tax reviews for as much as 3,000 transactions made on these platforms and get 10% off CoinTracker plans that help the syncing of some other Pockets or change.Be taught in regards to the newest crypto tax tipsTo entry tax instruments on coinbase.com, clients can faucet their profile within the higher proper hand nook and can see Taxes as a brand new merchandise within the drop down menu. To entry from the cellular app, clients will faucet the menu on the higher left hand facet, faucet Profile & Settings, and can see Taxes. Over the following few weeks, clients may also discover written guides on subjects like discovering the proper tax skilled and submitting taxes on NFTs plus explainer movies on capital features/losses and revenue.Coinbase is dedicated to creating it as straightforward as attainable to know and file crypto taxes. We’ll proceed enhancing tax instruments and creating new content material all through tax season as all of us navigate the evolving world of web3.

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.