[ad_1]

With vehicles changing into more and more related, quite a lot of assaults are rising: Automobile thieves abuse keyless entry methods, hackers discover new methods to use car parts, and fraud targets auto financing, automotive cybersecurity specialists stated in interviews this week.

In September, for instance, New York Metropolis police raided a car-theft ring that reportedly stole vehicles utilizing cloned key fobs primarily based on safety codes purchased on-line and encoded into a tool by an area locksmith. Additionally they used an aftermarket scanning device, usually utilized by mechanics, to reprogram focused vehicles’ ignitions to make them assume all of the keys had been misplaced.

The rise in electronic-enabled thefts is just one unintended consequence of the speedy adoption of related software program within the automotive house, says Man Molho, vp of merchandise for Upstream, supplier of cybersecurity providers for the trade.

“Auto OEMs are working to offer their clients with plenty of new capabilities, and these are new surfaces for hackers and assault vectors,” he says. “That floor space is simply going to develop, as a result of it’s now not only a automobile — it is a software program platform on wheels.”

Welcome to the way forward for related vehicles. Potential risks transcend alleged digital-enabled automobile thieves in New York Metropolis. In the UK, one other group used a tool resembling a Recreation Boy to idiot the keyless entry methods and steal greater than 30 Mitsubishi Outlanders in lower than three months, based on one other report.

A wide range of different assaults — from ransomware shutting down automobile producers, similar to Renault and Honda, to a white-hat researcher in a position to take restricted distant management of Teslas — point out the connectivity that permits high-tech vehicles to offer new options additionally represents a large enhance of their assault floor. In 2020, 54.6% of such incidents concerned a black-hat hacker, whereas white-hat researchers have been concerned in a lot of the relaxation, based on Upstream information. A small however rising share are homeowners investigating their very own automobiles.

And the variety of related vehicles continues to develop. Presently, a couple of quarter of vehicles are related to a community ultimately. By 2025, seven out of each eight automobiles will probably be related.

“Cyber threats within the automotive ecosystem are particularly worrying because of the potential direct impression on street customers’ security and safety,” Upstream acknowledged in its annual “International Automotive Cybersecurity Report.” “Autos themselves might be harmful; coupled with connectivity, the fashionable car is especially [dangerous].”

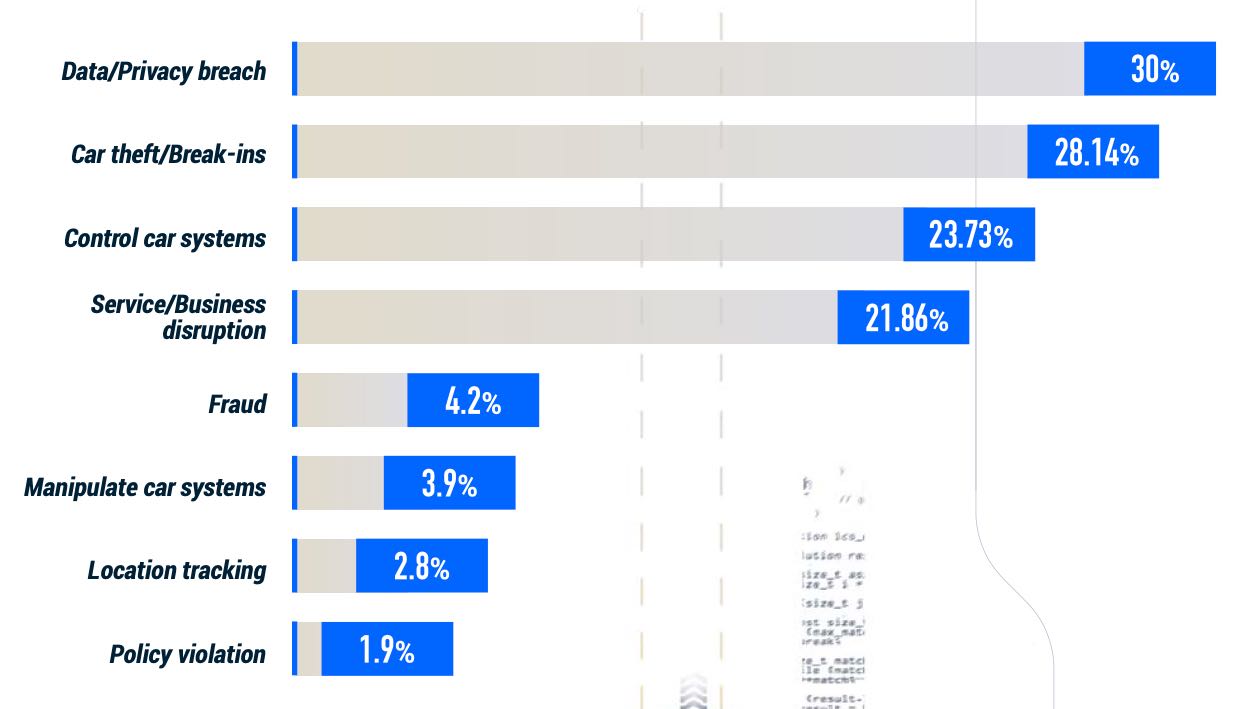

Whereas the best-known safety incident involving an vehicle is the 2015 Jeep Cherokee hack that allowed Charlie Miller and Chris Valasek to take management of a automobile, the most typical assaults are makes an attempt to compromise servers that host automotive providers (40%), assaults utilizing the important thing fob or keyless entry (25%), and assaults concentrating on automotive purposes for cell gadgets (9%). Assaults that focus on the infotainment system, use the onboard diagnostics (OBD) port, or goal a producer’s IT community every make up 6% of instances.

Wanting forward, makes an attempt at mass compromise will turn into extra frequent and thus goal parts of the related infrastructure, says Tomer Porat, lead analyst for Upstream.

“The assault vectors will probably be servers and exploiting vulnerabilities via the IT infrastructure of the OEM,” he says. Whereas a few of the points will come from poor design, others will probably be attributable to human error, based on Porat. “Builders usually make errors, posting delicate info on GitHub and different public locations, exposing the infrastructure.”

The auto ecosystem can be rife with monetary fraud, says Frank McKenna, chief fraud strategist and co-founder of Level Predictive, a agency that gives instruments to fight monetary fraud. Fraudsters, shoppers, and even sellers usually play quick and unfastened with purposes for automobile loans to make sure they make the sale. About 80% of lending fraud is dedicated so a client can qualify for a automobile mortgage; about 20% includes criminals attempting to make a revenue, McKenna says.

“The minute {that a} client tells you that they make twice as a lot cash as they’re truly making, after they begin to mislead you on materials details, then that’s fraud,” he says. “Fraud can price auto lenders wherever from 50 foundation factors to three% , if a lender doesn’t have good controls.”

Lastly, the quantity of knowledge produced and consumed by related vehicles has grown considerably. A contemporary related car will generate gigabytes of knowledge per day, which poses a issues for safety controls, says Upstream’s Molho.

“Vehicles produce a lot information, so a lot of the related automobiles have 5G connectivity to help the quantity of knowledge,” he says. “With over-the-air updates, they’re getting new options on a regular basis, and the information retains rising.”

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.