[ad_1]

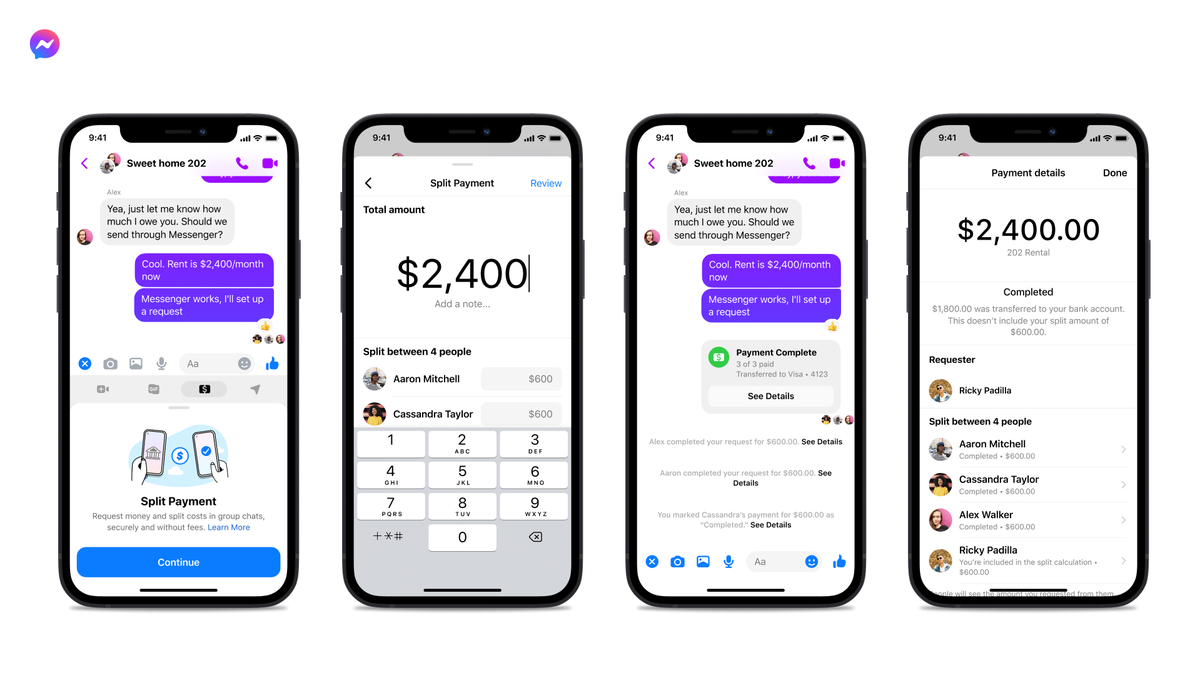

Though Fb Messenger’s entry into private finance isn’t new, I’ve by no means fairly managed to consider it as a funds platform. It’s extra an inbox that aunts, uncles, and pals from highschool blow up with messages after I haven’t posted on Fb shortly. However it’s now turning into increasingly more clear that Messenger will gladly deal with my cash if I let it.The Fb Messenger workforce offered a sneak peek of its new “Break up Funds” characteristic in a information announcement on Friday. It’s mainly a solution to manage and pay joint bills you’ve gotten with pals, roommates, coworkers, or anybody you’re splitting payments with. Much like apps like Splitwise, Break up Funds lets you create a shared expense, cut up the invoice evenly, or modify the contribution that corresponds to every particular person. You even have the choice to incorporate or exclude your self from the expense. As soon as all the data is within the app, you may ship out a request to the individuals who must pay you in Messenger, obtain the fee by means of Fb Pay (the corporate’s model of Venmo), and switch it to your checking account. “In the event you’ve struggled with dividing up (and getting paid again for) group dinners, shared family bills and even the month-to-month lease, it’s about to get simpler,” the Fb Messenger workforce mentioned within the information announcement. The corporate didn’t present many particulars on Break up Funds. From the promotional picture offered, it seems that it’s designed for use in Messenger group chats. Particular person-to-person funds are already doable by means of Fb Pay on Messenger, but it surely’s not clear if Break up Fee options, akin to splitting the invoice equally, might be out there in these cases. Not going to lie, Fb’s, or ought to I say, Meta’s, observe file on privateness, knowledge mining, and, nicely, all the pieces else doesn’t precisely encourage me to provide Messenger my bank card data. Plus, as I discussed earlier than, Messenger simply isn’t positioned that means in my mind. Certain, it’s tremendous apparent it desires me to belief it with my cash, however I’ve different apps for that. Safer ones with multi-factor authentication and nice customer support. Messenger will start to check Break up Funds subsequent week for customers within the U.S. The characteristic might be provided freed from cost. No data was offered on when the characteristic will roll out for everybody within the U.S. or whether or not it’ll roll out internationally.

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.