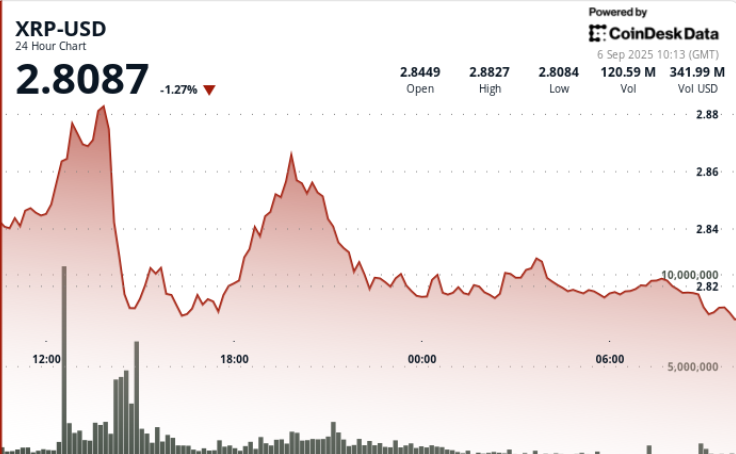

XRP didn’t maintain momentum above $2.88–$2.89, triggering a 4% decline as institutional promoting capped the advance. Heavy quantity confirmed resistance at these ranges, whereas patrons reappeared within the $2.81–$2.83 vary to stabilize value motion. The transfer retains XRP locked in a 47-day consolidation underneath $3.00, with merchants now eyeing the $2.77 help pivot and October’s SEC ETF choices as the following catalysts.Information BackgroundSix institutional asset managers have filed spot XRP ETF functions, with SEC choices anticipated in October.Whale accumulation continues, with roughly 340 million tokens bought in latest weeks regardless of persistent volatility.Trade balances stay elevated above 3.5 billion XRP, elevating questions of potential provide strain if promoting resumes.Federal Reserve coverage shifts and inflation prints are shaping broader liquidity circumstances throughout threat property.Earlier makes an attempt to interrupt greater noticed 227.7 million tokens commerce close to $2.88–$2.89, confirming that zone as agency resistance.Value Motion SummaryXRP traded inside a $0.08 vary from $2.81 to $2.89, representing 3% volatility.The sharpest decline got here at 14:00 on Sept 5, dropping from $2.88 to $2.81 on practically 280 million tokens traded.Stabilization adopted, with consolidation between $2.82 and $2.83 on lighter quantity.Closing value close to $2.82 stored XRP simply above the $2.77 help pivot, considered as the following key draw back guardrail.Technical AnalysisSupport: Robust bid zone recognized at $2.77–$2.81 following repeated defenses.Resistance: Instant ceiling at $2.88–$2.89, with $3.00 psychological stage and $3.30 breakout threshold above.Indicators: RSI sits mid-50s, reflecting neutral-to-bullish bias.MACD histogram converges towards bullish crossover, signaling potential momentum shift if quantity returns.Construction: Ongoing 47-day consolidation underneath $3.00, with an in depth above $3.30 opening potential path to $4.00+.What Merchants Are WatchingWhether $2.77 holds because the decisive help stage if promoting resumes.Value conduct on retests of $2.88–$2.89 resistance, significantly if quantity surpasses day by day averages.How whale accumulation offsets elevated alternate balances, which recommend latent provide threat.October SEC choices on spot XRP ETFs, considered as a key institutional adoption catalyst.Macro drivers from Fed coverage and inflation knowledge releases which will affect flows throughout digital property.

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.