[ad_1]

Fee App Growth: Information & Stats

Conventional banks are step by step dropping clients attributable to their complexity and contours. Digital options like fee apps are gaining reputation on the similar time. And it’s not surprising, both! The worldwide digital finance enterprise is increasing with a variety of apps—private monetary apps, on-line banking apps, cash switch apps, and many others. From 2021 to 2026, the fee app market is anticipated to develop by 23.8% per yr; due to this fact, now could be the best time for fee app growth.

In the US, most individuals actively use smartphones for day by day transactions. Greater than 200 million customers fall below this class. By 2023, researchers estimate that 52.5% of smartphones bought in the US alone will conduct no less than one monetary transaction. On account of their fast and straightforward operation processing, fee providers have gotten more and more in style.

Essentially the most promising peer-to-peer fee choices embrace standalone p2p cellular apps, transactional platforms, crypto-based p2p cellular wallets, and messaging-based fee apps.

An agile group with expertise, prototyping, and the discharge of an MVP with a trackable referral program are essential components for profitable fee app growth.

Because of this, now we have determined to offer data regarding fee apps and a step-by-step course of for creating one.

Fee Cellular App: Overview

A cash switch or fee app is a kind of app that allows customers to ship cash to others with out utilizing a checking account or bank card. Moreover, it permits customers to trade currencies and financial institution transactions utilizing cashless fee strategies.

How Do Fee Apps Work?

Though they look like fairly easy to finish customers, fee apps are fairly advanced. Let’s take a more in-depth have a look at how the fee app features.

Digital wallets are sometimes included in fee apps that permit customers to retailer cash that may later be used for transfers and funds domestically or internationally. If each events use the identical fee app, they will ship cash to 1 one other by specifying the recipient’s electronic mail tackle or cellular quantity. The cash despatched is debited from the sender’s pockets and credited to the recipient’s pockets.

In instances the place a checking account or bank card is concerned, encrypted information can be despatched to the fee processor, bank card issuers, or banks for verification that the required quantity is within the sender’s account.

Fee App Growth: Should-Add Options

Fee functions provide a variety of capabilities that may be helpful for each shoppers and companies. These apps make sending cash to pals, household, and different connections fast and simple. To avoid wasting customers from having to make use of money or spend hours paying their payments in particular person, in addition they present the chance to pay payments, purchase airtime, or make in-app purchases. The next is a listing of an important.

1. Digital Pockets

The power for finish customers to retailer, transmit, request, withdraw, and high up funds makes it the mind of the P2P fee system. Provided that VISA and Mastercard cowl the vast majority of nations and banking establishments, integrating their fee tokenization providers is crucial. These providers additionally provide customers of the app out-of-the-box capabilities, saving cash on peer-to-peer P2P fee app growth.

2. Request & Ship Funds

Customers of fee apps perform two important duties: transferring and requesting cash from different customers. As a result of this, a sturdy fee gateway is an absolute necessity for the app to simply accept transactions securely and rapidly.

3. Ship Invoices/Payments

Most firms and people incessantly ask for a transaction bill or invoice to verify that the sender has accomplished the cash switch operation. Due to this fact, companies ought to construct and supply customers with an intuitive possibility for creating payments and invoices that assist probably the most extensively used file sorts, together with PDF, email-centric, and in-app. A easy technique for sharing the created payments and invoices with the recipient can be applied.

4. Expense Monitoring

By helping customers in more practical cash administration, this function delivers worth. It entails categorizing all transactions by quantity, standing, location, and many others., and visualizing them. Customers will profit from superior UX and the chance to maximise their expenditure on this method.

5. On-line ID Checks

Fee apps incessantly embrace on-line ID checks since they safeguard each the sender and the recipient. The sender and the recipient could also be assured that their data is being delivered safely and that no scams or fraudulent actions will happen. There isn’t any want to satisfy in particular person or trade cellphone numbers because of fee apps with on-line ID verification.

Necessities To Contemplate Whereas Fee App Growth

1. Keep away from Storing Card Data

Despite the fact that it may appear apparent, it’s very important to make sure that the person’s debit/bank card data isn’t saved when buying on-line. Many people protect the knowledge to forestall having to enter the whole lot once more from scratch sooner or later and to facilitate faster funds. To attenuate the hazard of identification theft, it’s advisable to take away the cardboard particulars after making any on-line transaction.

2. For Transactions, Make Use Of A Non-public Window

One of the best ways to guard your self when making digital funds is to keep away from doubtful apps and web sites and solely use legit, trusted apps really helpful within the app retailer.

3. By no means Alternate Passwords

Though particular recommendation, it’s important to safeguard monetary stability. To forestall cyberattacks, customers’ web banking passwords have to be safe, by no means shared with anyone, and incessantly modified. Moreover, let the financial institution know when you ever obtain a bogus name from somebody requesting data like passwords or ATM PIN. Additional, it will be preferrred for transactions utilizing one-time passwords (OTP), as these are safer.

Fee App Growth Like WorldRemit: Steps To Create

1. Compile Your Necessities

Select the fee gateway app you need to use earlier than creating a fee platform. Determine what options your MVP should have to convey to finish clients the true advantage of your peer-to-peer fee software. The listing of important traits will support builders of cash switch functions comprehend technical elements.

2. Confirm Compliance With Laws

Many countries have tight rules governing the fintech and peer-to-peer fee industries. Be sure that the app complies with all PCI-DSS, or Fee Card Business Information Safety Commonplace, necessities. Do an in depth research on the world companies want to launch their app.

3. Create The UI & UX

The interface is your clients’ first and most vital level of contact. To find the golden technique of participating with purchasers, companies ought to create one thing distinctive but easy. We advise creating clickable prototypes, mockups, or wireframes that depict the last word person movement to enhance the person expertise.

4. Develop MVP Options

As soon as your design is full, chances are you’ll implement the chosen MVP options. Primarily based on their expertise and monitor information, contemplate companies which have expertise creating fee apps. Comply with these easy pointers when you rent a enterprise to develop a fee platform. They’ll help companies in making the very best supplier choice and in fee app growth.

5. Launch, Analysis, & Scale

Companies ought to launch their app and deploy the up to date model to manufacturing as quickly as its options and design are full. The principle goal right here is to make use of early buyer suggestions to validate the idea of your undertaking. That is typical as a result of your principal goal is to show the minimal viable product into a totally practical cellular fee system through fee app growth.

Extra Examples Of Fee Apps

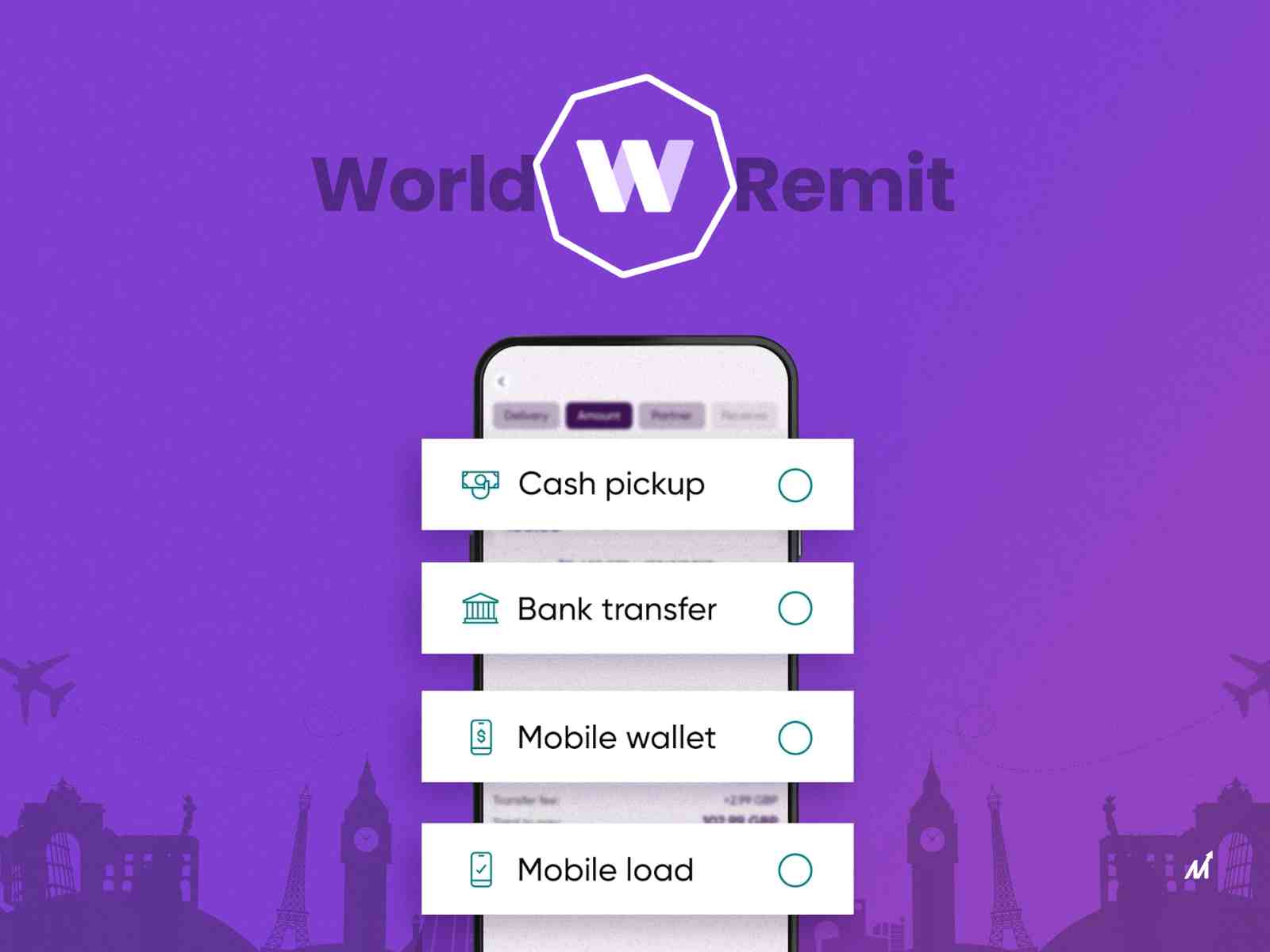

The truth that WorldRemit is among the many greatest methods to ship cash overseas can’t be disputed. It offers much better conversion charges than the financial institution and has a modern, user-friendly interface that makes sending funds quicker and extra handy.

Nevertheless, not everybody will discover utilizing WorldRemit to be the best alternative. There are different selections to look at whether or not WorldRemit doesn’t ship cash to the placement customers need it to or in the event that they consider they will discover decrease prices and foreign money charges elsewhere. Remitly, Clever, and Revolut are the highest three WorldRemit-equivalent functions.

1. Remitly

Remitly is a US-based digital remittance app that incessantly presents Monito customers the quickest and most inexpensive cash switch choices. It offers foreign money transfers to greater than 85 international locations worldwide, identical to WorldRemit, but it surely’s incessantly 2 to five occasions cheaper!

2. Clever

Clever is a well-liked platform for worldwide cash transfers that’s cheap and straightforward to make use of as a substitute for international financial institution transfers lately. It routinely high Monito’s listing of the least costly methods to ship cash internationally. The Clever cash switch service is ranked among the many greatest on Monito total (evaluate WorldRemit’s 7.7/10 to Clever’s 9.5/10 on our Monito Rating rating), and its cellular app is rated as the very best cash switch app. It helps transfers to dozens of foreign exchange worldwide, identical to WorldRemit.

3. Revolut

A well known identify in on-line banking, Revolut is a fintech firm with 12 million customers worldwide. Revolut presents a number of the most competitively priced worldwide cash transfers accessible anyplace available on the market, along with its cellular banking app and different sensible options (you need to signal as much as make transfers).

Fee App Growth: How A lot Does It Price?

Customers can ship and obtain fee transfers electronically utilizing this software. Though there are lots of totally different app classes, all of them can ship and obtain funds swiftly and conveniently. The price of constructing will differ primarily based on the options and performance you want. An easy resolution is perhaps created for as little as $5,000, though a extra difficult system with extra capabilities could value as a lot as $50,000. The app’s worth can be influenced by a number of variables, a few of that are:

The currencies that the app should assist

Variety of languages the app must assist

The variety of platforms the app must assist (iOS, Android, internet, and many others.)

Fee strategies (credit score/debit playing cards, financial institution transfers, money) the app must assist

The price of the fee app can differ primarily based on these components.

Fee App Growth: Markovate’s Take

Briefly acknowledged, the brand new beliefs of digital monetary providers are laying the groundwork for widespread acceptance sooner or later. Monetary providers are more and more being supplied by way of digital channels targeted on the patron. Essentially the most extensively used applied sciences additionally give new significance to developments within the building of fee apps.

It’s important to keep in mind that sending cash overseas isn’t free and that each foreign money transaction carries a price. Cash switch providers should not all created equal; some have far cheaper costs than others. Make the most of a minimal viable product to make sure that the app is worthwhile. Every of the app’s important options can be included. Moreover, it shows to customers what they might count on from the completed product. The MVP will also be utilized to attract in traders.

Nonetheless have issues? Markovate has been actively placing enterprise ideas into code and providing solutions to difficulties in the true world. Our professionals may streamline the intriguing strategy of creating a fee app. On-line commerce is feasible, and standard banking is already digital. Able to create a product that resembles the WorldRemit app?

Fee App Growth: FAQs

1. How a lot time does it take to construct a fee app like World Remit?

Though it’s troublesome, creating an software has a number of benefits. Primarily based on the complexity of the software program, the complete growth cycle earlier than launch can take anyplace between 4 and 6 months. Many companies make investments as much as 10 months within the creating section as a result of they do further analysis.

2. How does World Remit differ from PayPal when it comes to know-how?

Presently, PayPal solely transfers funds to different PayPal accounts or financial institution accounts. Transfers to financial institution accounts, cellular wallets, money pick-ups, airtime top-ups, invoice fee, Alipay, and door-to-door supply are all accessible by way of WorldRemit. As a result of its decrease charges, higher trade charges, and elevated fee and receiving choices, WorldRemit triumphs in each method. And attributable to its percentage-based price construction, PayPal continues to be a sensible choice for transfers below $300 or £200. As a result of its set prices and superior foreign money charges, WorldRemit is best for cash transfers over $300 or £200.

Rajeev Sharma

writer

I’m Rajeev Sharma, Co-Founder, and CEO of Markovate, a digital product growth firm. With over a decade of expertise in digital product growth, I’ve led digital transformations and product growth of enormous enterprises like AT&T and IBM.

My principal areas of competence embrace cellular app growth, UX design, end-to-end digital product growth, and product development. I maintain a Bachelor’s Diploma in Pc Science and certifications from the Scrum Alliance. Other than my work, I’m enthusiastic about Metaverse and carefully following the newest developments.

[ad_2]