[ad_1]

Ruling the headlines on the BSC community is now a norm for the Mars Ecosystem. Armed with a few of the highest APRs within the DeFi area and an ever-growing TVL, the staff just lately earned a Month-to-month Star within the Binance Sensible Chain “Most Useful Builders” program and is working in direction of reinventing the utility of Stablecoins. With BSC supporting Mars’ merchandise and expertise, it provides a layer of credibility to the consistently evolving Mars ecosystem. On this write-up, we’ll deep dive into stablecoins and what Mars Ecosystem means to the way forward for DeFi and crypto.

Stablecoins had been first launched as a mix of stability of fiat forex and mobility of cryptocurrencies. Usually, they’re backed by underlying belongings or algorithms. Stablecoins be sure that cash is borderless and accessible to everybody with out the necessity for a financial institution or a government.

Merely put, if Bitcoin is decentralized gold, then stablecoins are decentralized currencies.

Nevertheless, with time and utilization, particular attributes of stablecoins have turned them into the antithesis of decentralization. Additionally, they’ve ignited the hearth for the genesis of the Mars Ecosystem and its imaginative and prescient to reinvent stablecoin with decentralization and scalability intact.

Present Panorama of Stablecoins

The market cap of all stablecoins is price practically $128 billion with Tether (USDT) accounting for greater than half of the worth. Regardless of not having one decentralized stablecoin that fulfills the fundamental requisites, the stablecoin market enjoys an enormous upside, courtesy of DeFi. Each decentralized stablecoin protocol wants 1. Worth stability, 2. General decentralization, and three. Scalability.

At the moment, many of the stablecoins are overcollateralized which instantly impacts their scalability. Additionally, many stablecoins are pegged to belongings deposited in centralized programs which successfully goes in opposition to the ethos of blockchain expertise and DeFi. Although Algorithm-based stablecoins eliminate the collateral points, their value stability is a large concern.

Main Considerations of Stablecoins

Presently, each stablecoin protocol has its share of tradeoffs on the subject of the three properties. Nevertheless, all the problems boil down to 2 key issues. They’re 1. The optimistic externality downside, 2. The mixing downside.

The optimistic externality downside displays the imbalance in efforts to reward ratio for the stablecoin protocols. The price of producing and sustaining stablecoins is borne by the protocol and its customers. Nevertheless, stablecoin’s worth is generated in DeFi purposes. The monetary incentive for the stablecoin protocol is minimal which regularly finally ends up with a scarcity of provide.

The mixing downside is sort of much like the earlier concern of how stablecoins’ worth is solely determined by DeFi apps. Stablecoins are impacted by their ease of integration with numerous DeFi protocols. If a stablecoin can’t be built-in with a sure DeFi protocol simply, the stablecoins’ stability is affected.

To resolve these, Mars Ecosystem stands aside as a decentralized stablecoin paradigm with an all-inclusive system to seize the true utility of stablecoins.

Mars Ecosystem 101

As a possible resolution to the optimistic externality and integration issues Mars Ecosystem presents a three-part system. Their efforts are targeting producing a stablecoin ecosystem with excessive value stability, excessive decentralization, and scalability potential.

These efforts have been acknowledged by the Most Useful Builder (MVB), an initiative by Binance Sensible Chain to help modern initiatives. The Mars Ecosystem was one of many winners of the MVBIII – September Month-to-month Stars. Additionally, the Mars Ecosystem will obtain key help from BSC, not restricted to monetary inflow. The mentoring and technical help offered generally is a gamechanger for the Mars Ecosystem.

The three cores of the Mars Ecosystem are;

Mars Treasury

That is the muse on which the Mars Ecosystem resides and grows. Its constructing blocks are $USDM or USD-Mars (Mars Ecosystem stablecoin) and $XMS or Mars Ecosystem Token (Mars Ecosystem governance token). Their treasury is constructed to help a number of kinds of cryptos from the likes of BTC to DeFi blue chips.

The staff is provided with minting and redemption mechanisms for the circulation of $USDM. With a set 1:1 ratio, customers can deposit their belongings into the Mars Treasury to mint $USDM and vice-versa. The circulation of $USDM fuels the worth of $XMS which can be utilized to take part within the governance of the protocol.

Mars Stablecoin

$USDM stablecoin will be minted with $1 price of any of the Mars Treasury white-listed belongings. The utmost provide of the $USDM is relative to the market cap of $XMS. This cover in provide is a part of their mintage management mechanism which accounts for customers’ habits to make sure the worth of $USDM is at all times secure.

Additionally, an anti-bank run mechanism has been enabled to guard $USDM from mass shorting and a possible collapse. That is ensured by incentivizing the holding time of the token. Malicious actors making an attempt to encash on the distinction within the collateral ratio of $USDM and $XMS fail of their efforts as fast gross sales are burdened with slippage losses. This makes financial institution runs an unfeasible exercise within the Mars Ecosystem.

Mars DeFi Protocols

It is a sequence of functionalities being added to the Mars Ecosystem to facilitate transactions, enhance liquidity, and improve $USDM’s utility as a medium of alternate and retailer of worth. First within the sequence of DeFi protocols is Mars Swap which is an automatic market maker-powered DEX much like Uniswap.

This DEX is designed to offer 24/7 liquidity for $USDM and different DeFi protocols that undertake $USDM as a token of alternate. Additionally, the transaction charges generated on Mars Swap are pushed again into the Mars Treasury the place liquidity suppliers and $XMS holders and stakers are awarded.

Since $USDM customers earn with out leaving the ecosystem, the optimistic externality concern is resolved. Additionally, the worth generated right here incentivizes the holding of $XMS which in flip stabilizes $USDM because the latter’s provide is predicated on the previous’s market cap.

Staking and Liquidity Provision

September noticed the launch of Mars Ecosystem liquidity farms and swimming pools. Presently, the overall locked worth has crossed $250 million with the typical APR being greater than 1000% Already, eight swimming pools have been created for customers to stake their $XMS and earn BNB, ETH, CAKE, or extra XMS as per their desire. Alongside, greater than 10 yield farms have been arrange for liquidity provision. 0.25% of the transaction charges on Mars Swap go on to liquidity swimming pools.

Additionally, the staff is introducing many liquidity swimming pools and farms in unison with different initiatives within the BSC community. Venus Protocol, Kalata Protocol, ForTube, Helmet Insure are a few of the initiatives they’ve partnered with in creating liquidity swimming pools and farms.

Other than this, they’ve coupled sustainability with the expansion of farms and swimming pools utilizing a linear vesting interval. Merely put, the $XMS token allotted to traders (8%) and the staff (10%) might be slowly launched. This implies, as per $XMS’s complete provide, 180 million $XMS might be launched for intervals of 18 (traders) and 36 (staff) months. The vesting interval will begin from our genesis launch which might be held in a month.

Way forward for Mars Ecosystem

Neighborhood-first is how the Mars Ecosystem staff is approaching the long run. Particular emphasis might be positioned on the course that their group desires to take, in unison with their roadmap that features launching extra DeFi protocols and incubating nascent initiatives.

Everybody holding $XMS tokens can take part in MarsDAO and contribute to the evolution of the Mars Ecosystem. Additionally, they are going to be opening their NFT assortment to the group to buy alongside a number of airdrops for fortunate winners. The Boarding Cross NFT and the Captain NFT have been designed to reward those that have contributed to the preliminary MarsDAO group.

They imagine that ‘To the Mars’ would be the new ‘to the moon’ within the crypto and DeFi group. However, instead of the volatility, we’ll see if the stablecoin $USDM will develop into being the reserve forex of the DeFi world.

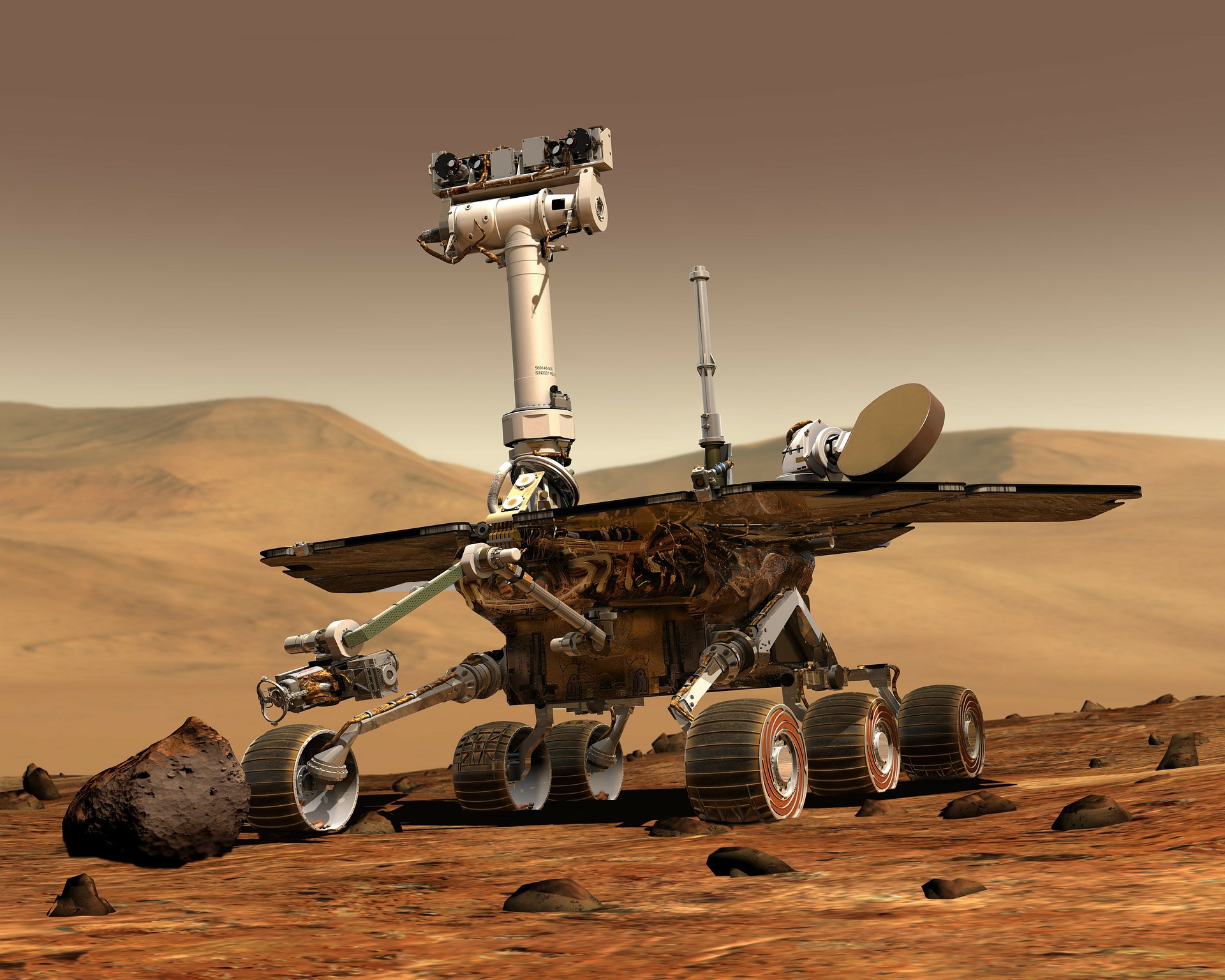

Picture by WikiImages from Pixabay

[ad_2]