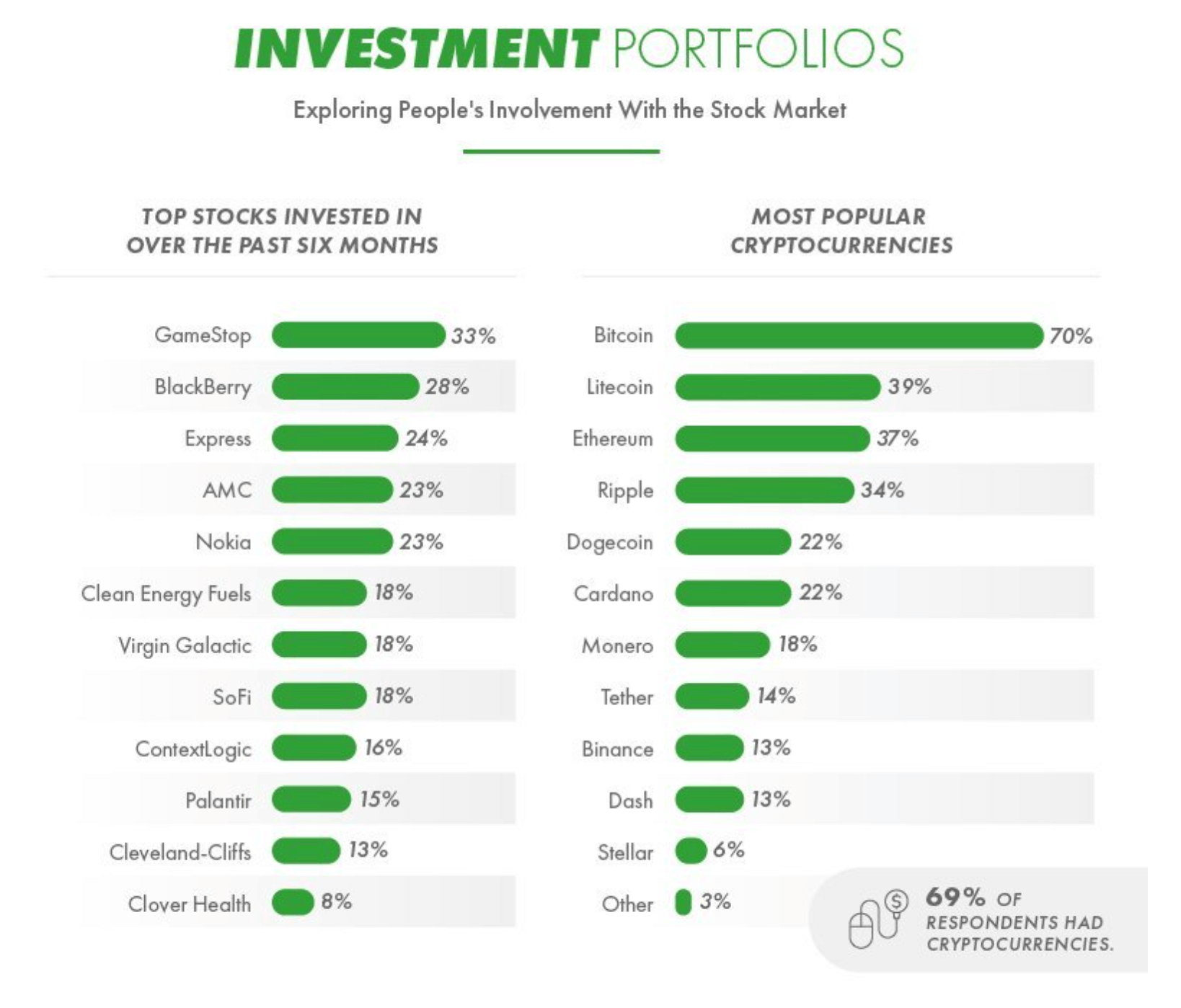

To be able to gauge retail traders’ inventory market data, the web on line casino reviewer GamblersPick spoke to greater than 1,000 individuals who have invested not less than as soon as.Based on the survey outcomes, respondents who owned cryptocurrencies scored considerably decrease than traders who didn’t personal any crypto.The outcomes additionally revealed that 70% of digital traders have invested in Bitcoin (BTC), in comparison with 39% who invested in Litecoin (LTC), the second hottest coin.High Portfolio ChoicesThe examine first requested the members about what they’ve invested in and found that 69% of respondents owned cryptocurrencies.In continuation, the report checked out which shares and cryptocurrencies are hottest amongst retail traders.“GameStop was the preferred inventory for our respondents within the final six months. A 3rd of traders had put their cash on this firm,” learn the report, including that the second hottest selection was one other “meme inventory,” BlackBerry.So far as cryptocurrencies go, the world’s largest crypto surfaced as the preferred by far, with 70% of digital traders responding they purchased Bitcoin.Whereas 39% of respondents mentioned that they invested in Litecoin, 37% reported they purchased Ethereum (ETH).How a lot do beginner traders know?“Swathes of latest traders have entered the inventory market because the pandemic, with first-timers now making up 15% of all retail traders,” the report identified, because it continued to deal with the commonest data gaps.Regardless of the quick promote behind the GameStop frenzy, 83% of respondents didn’t correctly establish the “quick promoting” definition in a a number of selection query.Brief promoting implies borrowing a share of a inventory after which promoting it.If the worth performs as anticipated, merchants can rebuy the inventory when its value falls and maintain onto the distinction.As well as, most individuals couldn’t establish the right time period for the abbreviation GME, as 73% of respondents failed to acknowledge it for instance of a “ticker image.”Greater than half of traders couldn’t correctly clarify what the “ask” and the “bid” have been.In easy phrases, the “bid” value is the utmost quantity {that a} purchaser is ready to pay for a inventory, whereas the “ask” is the minimal value {that a} vendor would take for that very same inventory.Different frequent data gaps surfaced when the respondents have been requested to appropriately outline “hedge funds,” “mutual funds,” and “trade funds.”“What made the actual distinction was whether or not or not an individual owned cryptocurrencies,” learn the report, noting that those that didn’t carried out a lot better than those that did.Based on GamblersPick, one of many potential explanations is that cryptocurrencies are inclined to attraction to youthful and fewer skilled traders.It is also the case that crypto traders are opting out of the normal inventory market altogether and have little curiosity in gaining inventory market data.Apart from gauging data gaps, the survey additionally explored the final angle in the direction of the market and investing, and revealed that 67% of the respondents felt the inventory market is rather like playing.Get an edge on the cryptoasset marketAccess extra crypto insights and context in each article as a paid member of CryptoSlate Edge. On-chain evaluation Worth snapshots Extra context Be part of now for $19/month Discover all benefitsPosted In: Adoption, Investments Like what you see? Subscribe for updates.

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.