[ad_1]

Key Takeaways

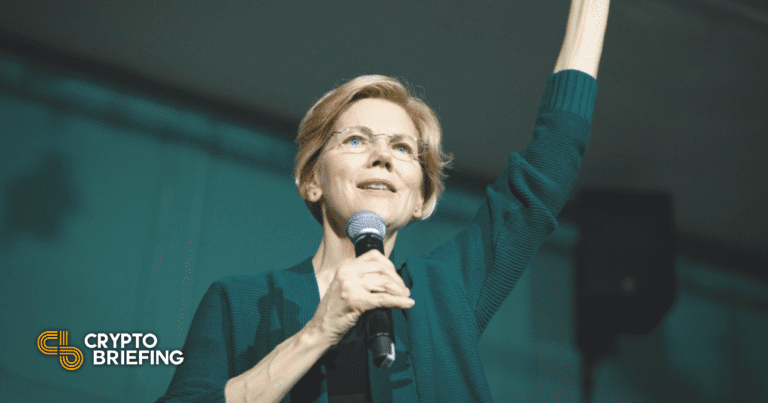

Senators Elizabeth Warren and Sheldon Whitehouse requested the Division of Justice to analyze FTX at the moment.

In a letter, they outlined FTX’s failures and highlighted the consequences of its collapse on retail traders.

Warren has made varied different statements regarding FTX this month within the aftermath of its collapse.

Share this text

Senators Elizabeth Warren and Sheldon Whitehouse have demanded an investigation into FTX’s failure.Warren, Whitehouse Demand DOJ ActionFTX might quickly face additional investigations.In a letter revealed at the moment, Senators Warren (D-MA) and Whitehouse (D-RI) requested the U.S. Division of Justice (DOJ) to “maintain [FTX’s] executives accountable to the fullest extent of the regulation.”

The senators famous that the once-leading crypto change, together with at the least 130 affiliated corporations, filed for chapter this month. In addition they noticed that FTX’s collapse had had a ripple impact within the monetary trade, noting that lending companies and hedge funds comparable to Genesis Capital and Galois Capital had thousands and thousands of {dollars} locked on FTX, whereas crypto lender BlockFi had suspended withdrawals in response to the change’s implosion.The senators urged the DOJ to focus its investigation on how FTX harmed its prospects. Warren and Whitehouse claimed that FTX had deceived prospects via commercial and superstar endorsements and that former FTX CEO Sam-Bankman Fried had downplayed liquidity considerations when customers realized they might now not withdraw their funds shortly earlier than the agency lastly collapsed.They went on to notice that present FTX CEO John Jay Ray highlighted a lot of FTX’s failures this previous week. Ray famous in public filings that FTX suffered from poor regulatory oversight, concentrated administrative management amongst inexperienced leaders, and hid its misuse of buyer funds.Warren and Whitehouse concluded that FTX’s collapse was “not merely a results of sloppy enterprise and administration practices” however relatively “intentional and fraudulent techniques employed by [FTX executives] to complement themselves.” The 2 senators mentioned that FTX’s debt discharge might complete $8 billion and could also be owed to at least one million prospects, particularly working and middle-class retail traders.“We urge the Division to middle these ‘flesh-and-blood victims’ because it investigates, and, if it deems vital, prosecute the people chargeable for their hurt,” the letter reads.This isn’t Warren’s first assertion relating to FTX’s collapse. Alongside fellow senator Dick Durbin, she despatched a letter on November 16 urging FTX to offer regulators with info. Warren additionally revealed an op-ed within the Wall Avenue Journal yesterday, the place she known as FTX’s collapse a “wake-up name” for regulators, together with the DOJ, Securities and Alternate Fee, and U.S. Treasury. Current reviews counsel that a few of these businesses are already within the strategy of investigating FTX.Disclosure: On the time of writing, the writer of this piece owned BTC, ETH, and different digital belongings.

Share this text

The knowledge on or accessed via this web site is obtained from unbiased sources we imagine to be correct and dependable, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed via this web site. Decentral Media, Inc. will not be an funding advisor. We don’t give customized funding recommendation or different monetary recommendation. The knowledge on this web site is topic to vary with out discover. Some or all the info on this web site might turn into outdated, or it might be or turn into incomplete or inaccurate. We might, however are usually not obligated to, replace any outdated, incomplete, or inaccurate info.

You need to by no means make an funding determination on an ICO, IEO, or different funding based mostly on the data on this web site, and it is best to by no means interpret or in any other case depend on any of the data on this web site as funding recommendation. We strongly suggest that you just seek the advice of a licensed funding advisor or different certified monetary skilled if you’re in search of funding recommendation on an ICO, IEO, or different funding. We don’t settle for compensation in any kind for analyzing or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

See full phrases and situations.

[ad_2]