[ad_1]

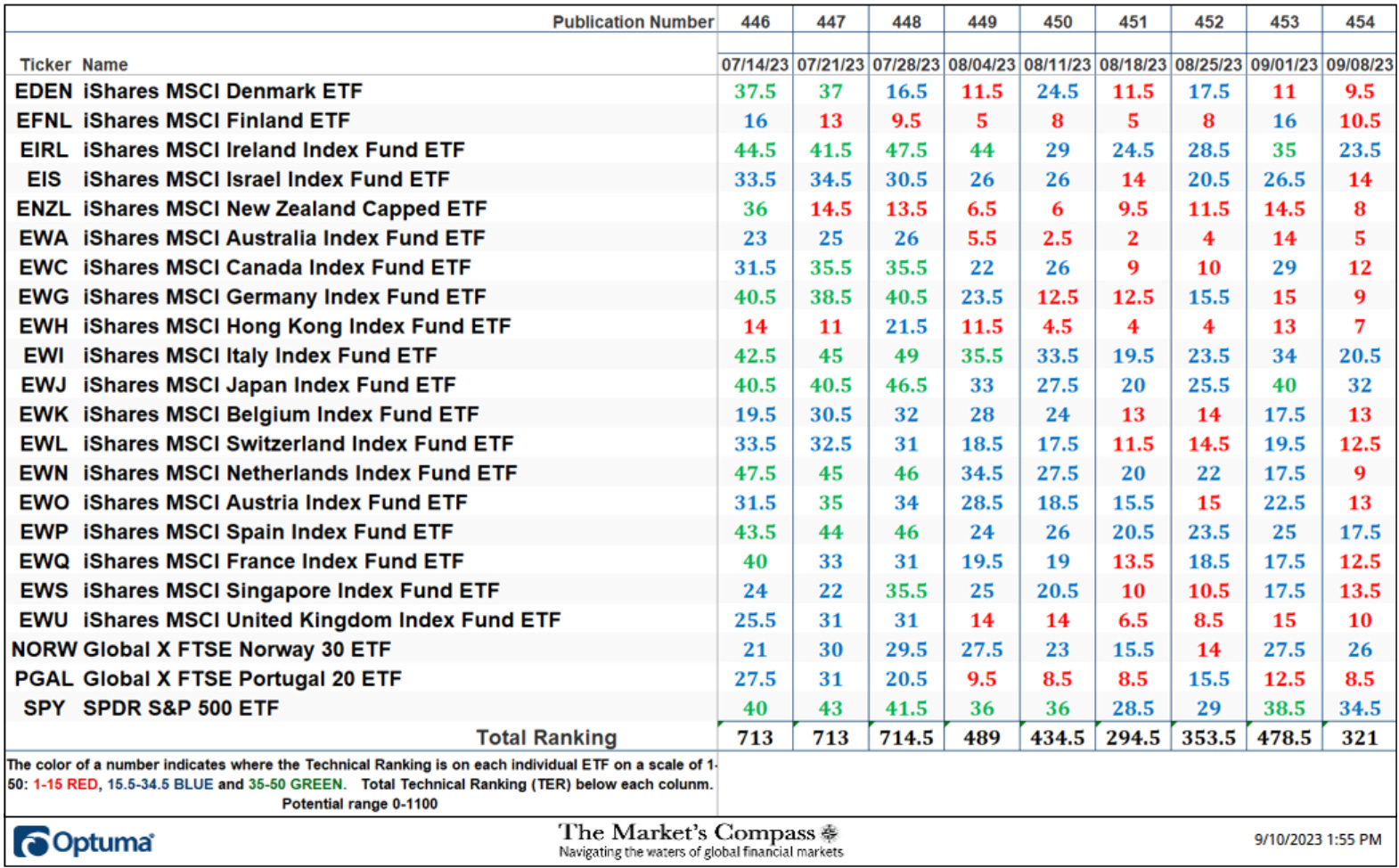

Welcome to this week’s publication of the Market’s Compass Developed Markets Nation (DMC) ETF Research #454. It continues to focus on the technical modifications of the 22 DMC ETFs that we observe on a weekly foundation and share our technical opinion on, each three weeks. There are three ETF Research that embrace the Market’s Compass US Index and Sector (USIS) ETF Research, the Developed Markets Nation (DMC) ETF Research and the Rising Markets Nation (EMC) ETF Research. The three Research will individually be revealed each three weeks and despatched to paid subscriber’s e-mail. There’s now a Weekly publication that’s despatched to paid subscribers each Sunday titled The Market’s Compass Crypto Candy Sixteen Research that tracks the technical situation of sixteen of the bigger cap Cryptocurrencies that additionally makes use of (just like the ETF Research) an goal technical rating mannequin amongst different measures together with relative power and my most popular technical evaluation instruments.This Week’s and eight Week Trailing Technical Rankings of the 22 Particular person ETFsThe Excel spreadsheet beneath signifies the weekly change within the goal Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a completely quantitative strategy that makes use of a number of technical issues that embrace however aren’t restricted to pattern, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical Rating (“TR”) rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take-away from this unfold sheet ought to be the pattern of the person “TRs” both the continued enchancment or deterioration, in addition to a change in path. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity might be seen as an overbought situation however with due warning over offered situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply develop into extra overbought. A sustained pattern change must unfold within the particular person TR for it to be actionable.On a WoW foundation the Whole Developed Markets ETF Rating (“TER”) fell -49.07% to 321 from 478.5. After reaching a low of 294.5 4 weeks in the past the TER had risen to 478.5 two weeks in the past however has turned decrease once more to final weeks studying.All twenty two of the Developed Market TRs we observe in these web page noticed a drop of their TRs on a WoW foundation marking an throughout the board technical deterioration. As might be seen above, on the finish of final week there have been six ETFs within the “blue zone” (15.5 to 34.5) and fourteen have been within the “purple zone” (0 to fifteen). This was versus the week earlier than when three ETFs had TR within the “inexperienced zone” (35-50), twelve have been within the “blue zone” and 7 have been within the “purple zone”. The Common TR lack of the 22 Developed Markets Nation ETFs final week was -7.15. Three of the the biggest drops in TRs was regestered by the iShares MSCI Canada Index Fund ETF (EWC) which fell -17 to 12 from 29 adopted by the iShares MSCI Italy Index Fund ETF (EWI) which dropped -13.5 “handles” to twenty.5 from 34 and the iShares MSCI Israel Index Fund ETF (EIS) which misplaced -12.5 factors to 14 from 26.5.The Technical Situation Issue Adjustments over the previous week and former 8 weeksThere are eight Technical Situation Elements (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic a further level is added to the person TR. Conversely if the technical query is adverse, it receives a “0”. A couple of TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 22 ETFs. Due to that, the excel sheet above calculates every issue’s weekly studying as a p.c of the potential whole. For instance, there are 7 issues (or questions) within the Each day Momentum Technical Situation Issue (“DMTCF”) of the 22 ETFs (or 7 X 22) for a potential vary of 0-154 if all 22 ETFs had fulfilled the DMTCF standards the studying can be 154 or 100%.A 28.57% studying within the DMTCF was registered for the week ending September eighth, or 44 of a potential whole of 154 optimistic factors. 4 weeks in the past a deep oversold studying of 1.30% was registered and it was the bottom degree reached for the reason that the week ending February twenty ninth studying of 0.65%. As a affirmation device, if all eight TCFs enhance on every week over week foundation, extra of the 22 ETFs are bettering internally on a technical foundation, confirming a broader market transfer greater (consider an advance/decline calculation). Conversely, if extra of the 22 TCFs fall on every week over week foundation, extra of the ETFs are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week all eight TCF fell confirming the broad technical deterioration within the 22 Developed Markets Nation ETFs.The URTH with This Week’s Whole ETF Rating “TER” Overlaid*The Whole Technical ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and might be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence device: If the broader market as measured by the iShares MSCI World Index ETF (URTH) continues to rally and not using a commensurate transfer or greater transfer within the TER the continued rally within the URTH turns into more and more in jeopardy. Conversely, if the URTH continues to print decrease lows and there may be little change or a constructing enchancment within the TER a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 degree (all 22 ETFs having a TR of fifty) “issues can’t get significantly better technically” and a rising quantity particular person ETFs have develop into “stretched” the extra of an opportunity of a pullback within the URTH. On the flip facet the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in Purple smooths the risky TER readings and analytically is a greater indicator of pattern.After a pointy bounce within the DM Whole ETF Rating (“TER”) two weeks in the past to 478.5 the TER fell again sharply to final weeks studying to 321. That drop retains the 13-Week Shifting Common of the TER in its 7-month downtrend and leaves the non-confirmation of the late July highs in place.The Common Technical Rating of the 22 Developed Markets Nation ETFs*The weekly Common DM Technical Rating (“ATR”) is the common of the person Technical Rankings of the 22 Developed Markets Nation ETFs we observe. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.The collection of decrease highs within the ATR stays in place reiterating the the non-confirmation of the late July highs that was capped on the Higher Warning Line (purple dashed line UWL) of the Schiff Modified Pitchfork (purple P1-P3). Each the longer-term 45-Week Exponential Shifting Common (blue line) and the 9-Week Easy Shifting Common (purple line) of the ATR continues to trace decrease after the failure of the shorter-term transferring common to retake the bottom above the longer-term transferring common. Solely a rally above the Higher Parallel (stable gold line) of the Customary Pitchfork (gold P1-P3) would change my bearish bias. Extra on my ideas of the short-term technical situation of the URTH later within the Weblog, however first…The Weekly Absolute and Relative Worth % Change**Doesn’t embrace dividendsAll 22 of the Developed Markets Nation ETFs we observe in these pages have been down on an absolute foundation final week. The common absolute lack of all 22 ETFs was -2.0% versus a -1.42% loss within the URTH. Solely 4 ETFs outperformed the iShares MSCI World Index and eighteen ETFs underperformed on a relative foundation. The most important WoW absolute loss was registered by the iShares MSCI Hong Kong Index Fund ETF (EWH) which fell -3.69%.Ideas on the short-term technical situation of the URTH**Of curiosity to scalpers, merchants, and techniciansWhen we final revealed the Developed Markets Nation ETF Research for the week ending August 18th (inexperienced highlighted candle) the URTH had damaged beneath Cloud help and had reached a deeply oversold situation as witnessed by the DM Nation ETF Each day Momentum / Breadth Oscillator and a restoration rally developed. This was in live performance with a flip within the Fisher Remodel and adopted by MACD overtaking its sign line. Costs discovered a measure of help on the Second Decrease Warning Line (gold dashed line LWL2) of the long run Schiff Modified Pitchfork (gold P1-P3) and the rally prolonged to the highest of the Cloud earlier than reversing course. That value reversal gave delivery to the brand new shorter time period Schiff Modified Pitchfork (Purple P1-P3). The 4 session pullback discovered help as soon as once more on the Second Warning Line final Thursday stemming the decline earlier than the URTH broke Cloud help and the Median Line (purple dashed line) of the newer Schiff Modified Pitchfork. Solely a rally by the Higher Parallel (stable purple line) and transfer out and above the Cloud mannequin would counsel one thing extra bullish was growing.Relative Return vs. The URTH Since January 1st 2023**Doesn’t together with dividendsCharts are courtesy of Optuma. Any timeseries information might be imported, charted, and examined in Optuma.To obtain a 30-day trial of Optuma charting software program go to…www.optuma.com/TMC.A 3 half tutorial collection on Andrews Pitchfork could also be learn at my web page…. www.themarketscompass.com

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.