[ad_1]

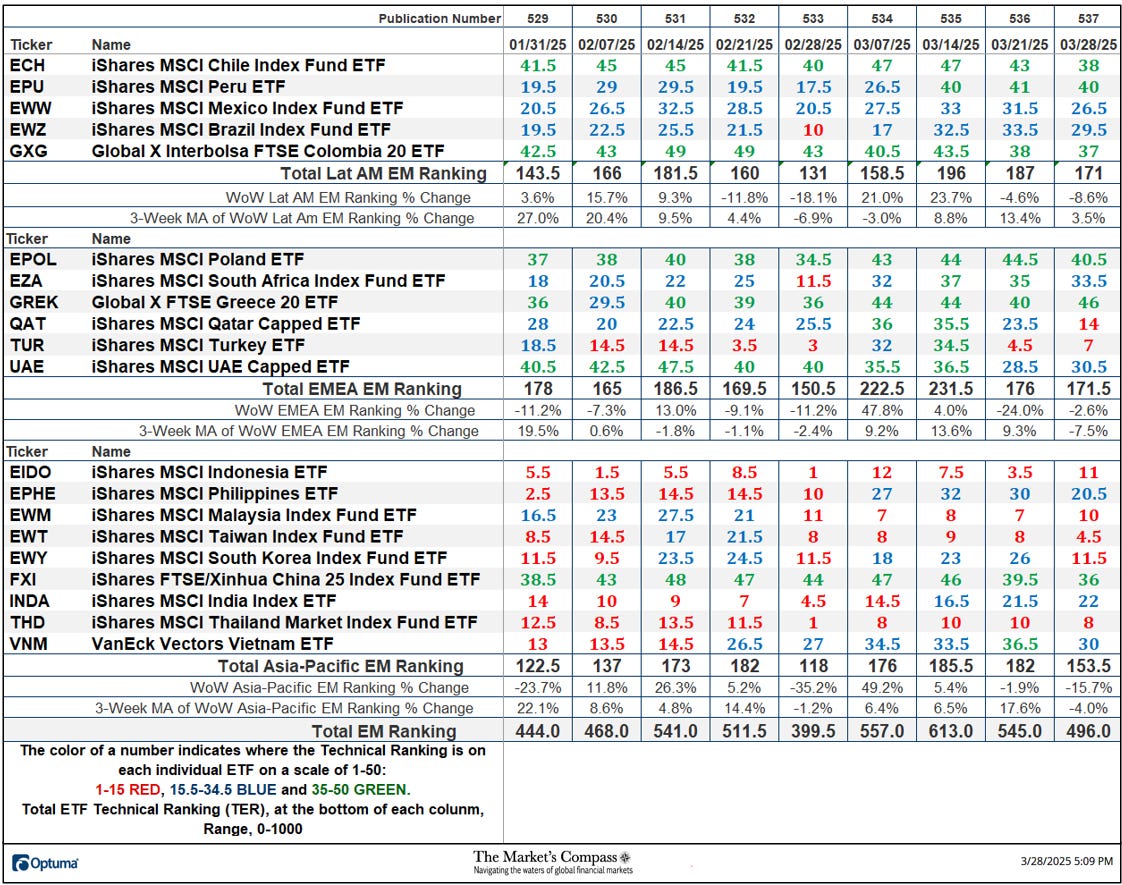

Welcome to The Market’s Compass Rising Market’s Nation ETF Examine, Week #537. As all the time, it highlights the technical modifications of the 20 EM Nation ETFs that I monitor on a weekly foundation and publish each third week. Paid subscribers will obtain this week’s unabridged Rising Market’s Nation ETF Examine despatched to their registered e-mail. Free subscribers will obtain, every so often, an excerpt of the complete model. Previous publications may be accessed by paid subscribers by way of The Market’s Compass Substack Weblog. Subsequent week we will likely be publishing the The Market’s Compass Developed Markets Nation ETF Examine. On Sunday I revealed the most recent version of The Market’s Compass Crypto Candy Sixteen Examine which I publish on a weekly foundation and tracks the technical modifications of sixteen of the bigger capitalized Cryptocurrencies.To grasp the methodology utilized in setting up the target EM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.This previous week The Complete EM Technical Rating, “TEMTR” fell by -8.99% to 496 from 545 including to the -11.09% loss the week earlier than from 613 three weeks in the past. The Complete Asia-Pacific EM Rating fell the many of the three, down -15.7% to 153.5 from 182 the earlier week. The Complete Lat AM EM Rating fell -8.6% to 171 from 187. The EMEA EM Complete Technical Rating fell the least, down -2.6% to 171.5 from 176 the earlier week. It needs to be famous that the iShares MSCI Turkey ETF (TUR) TR has currently been on a nasty worth and TR “curler coaster experience”. After rising to 34.5 three weeks in the past, it fell by 30 “handles” to 4.5 two weeks in the past earlier than final week’s small restoration to 7. Posted beneath is the every day candle stick chart of the TUR with MACD within the decrease panel.Six of the twenty EM Nation ETFs I monitor in these pages registered enchancment of their TRs on a WoW foundation, and fourteen ETF TRs fell. The common TR loss was -2.45 vs. the earlier week’s common TR lack of -3.40 when 13 out of twenty fell. Six of the EM Nation ETF TRs ended the week within the “inexperienced zone” (TRs between 34.5 and 50), seven have been within the “blue zone” (TRs between 15.5 and 34) and 7 have been within the “pink zone” (TRs between 0 and 15). That was a slight deterioration from the earlier week when eight have been within the “inexperienced zone”, seven have been within the “blue zone” and 5 have been within the “pink zone”.*To grasp the development the of The Technical Situation Elements go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.This previous week a 32.86% studying was registered within the Every day Momentum Technical Situation Issue (”DMTCF”) or 46 out of a attainable whole of 140 constructive factors. That was a drop from the week earlier than studying of fifty.71% or 71 which was a continued drop from 75.71% or 106 three weeks in the past.As a affirmation instrument, if all eight TCFs enhance on a week-over-week foundation, extra of the 20 ETFs are enhancing internally on a technical foundation, confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fall on a week-over-week foundation it confirms a broader market transfer decrease. Final week all two TCFs rose, and 6 fell.*A short clarification of how you can interpret RRG charts go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”. To study extra detailed interpretations, see the postscripts and hyperlinks on the finish of this Weblog.The chart beneath has three weeks, or 15 days, of Relative knowledge factors vs. the benchmark, the CCi30 Index, on the heart, deliniated by the dots or nodes. Not all 20 ETFs are plotted on this RRG Chart. I’ve performed this for readability functions. These which I consider are of upper technical curiosity stay.After viewing the every day chart of the iShares MSCI Turkey ETF (TUR) earlier on this week’s weblog the sharp reversal in Relative Energy and Relative Energy Momentum is hardly a shock. Every week in the past, final Monday the TUR started to roll over within the Main Quadrant and started to quickly lose Relative Energy Momentum because it accelerated decrease within the Weakening Quadrant (notice the space between the nodes or dots that mark the day-to-day change). Final Tuesday it gathered a tempo and entered the Lagging Quadrant. Diametrically opposed over the previous two weeks has been the iShares MSCI India Index ETF (INDA) which has exhibited a managed advance out of the Enhancing Quadrant into the Main Quadrant. The World X FTSE Greece 20 ETF (REK) had been rising at a great “clip” within the Main Quadrant three weeks in the past till it stalled and rolled over and entered the Weakening Quadrant on the finish of final week.A proof of the The Complete EM Technical Rating Indicator and its interpretation go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.The EEM has been buying and selling sideways for the reason that center of February. The TER did mark mark the next excessive three weeks in the past however has since rolled over,, however the 13-week exponential transferring common continues to trace larger (other than a quick blip decrease) for the reason that January tenth flip when the TER bottomed. Extra on the long-term technical situation of the EEM within the Candlestick chart that follows.The Common Weekly Technical Rating (“ATR”) is the typical Technical Rating (“TR”) of the 20 Rising Markets Nation ETFs we monitor weekly and is plotted within the decrease panel on the Weekly Candle Chart of the EEM introduced beneath. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.The Weekly Candlestick Chart above higher displays the sideways worth motion over the previous seven weeks, then the previous a lot longer-term line chart. After a follow-through advance on the worth pivot low for the week ending January seventeenth that held at Cloud help, the EEM rallied again into the confines of the longer-term Customary Pitchfork (violet P1 by way of P3). I then added a shorter-term Customary Pitchfork (pink P1 by way of P3). Regardless of the sideways worth motion costs have dutifully held help on the Higher Span of the of the Cloud and the Decrease Parallel (stable pink decrease line) of the Pitchfork. MACD displays the slowing of upside worth momentum and the shorter-term Stochastic Momentum Index has turned decrease and has simply edged beneath its sign line. Solely a rally that drives costs by way of the 45.50 degree and the Median Line (violet dotted line) of the longer-term Customary Pitchfork would counsel that there’s something greater than a counter pattern rally is growing.Find out about Pitchforks and Inner Traces within the three-part Pitchfork tutorial within the Market’s Compass web site, www.themarketscompass.comMore on the technical situation of the EEM in Ideas on the Brief-Time period Technical Situation of the EEM however first…*For the week ending March twenty eighth. Doesn’t embrace dividends if any.5 of the twenty EM Nation ETFs have been up on an absolute foundation final week (the EZA was flat on the week) and fourteen traded decrease. Fifteen EM ETFs outperformed the -1.82% loss within the EEM on a relative foundation. The common five-day absolute loss in EM ETFs was -0.53% (together with the EEM), reversing the earlier week’s common absolute achieve of +1.21%.After falling beneath potential help on the Kijun Plot on Friday, the EEM ended the week teetering on Every day Cloud help. Each momentum oscillators and the Fisher Rework are monitoring decrease beneath their sign strains. The EM Nation ETF Every day Momentum / Breadth Oscillator continues to course decrease beneath each transferring averages. A break of Cloud help will doubtless goal help on the VAP (Quantity at Value) band at 43/43.25.All of the charts are courtesy of Optuma whose charting software program permits anybody to visualise any knowledge together with my Goal Technical Rankings. The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…https://www.optuma.com/movies/introduction-to-rrg/https://www.optuma.com/movies/optuma-webinar-2-rrgs/To obtain a 30-day trial of Optuma charting software program go to…www.optuma.com/TMC.

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.