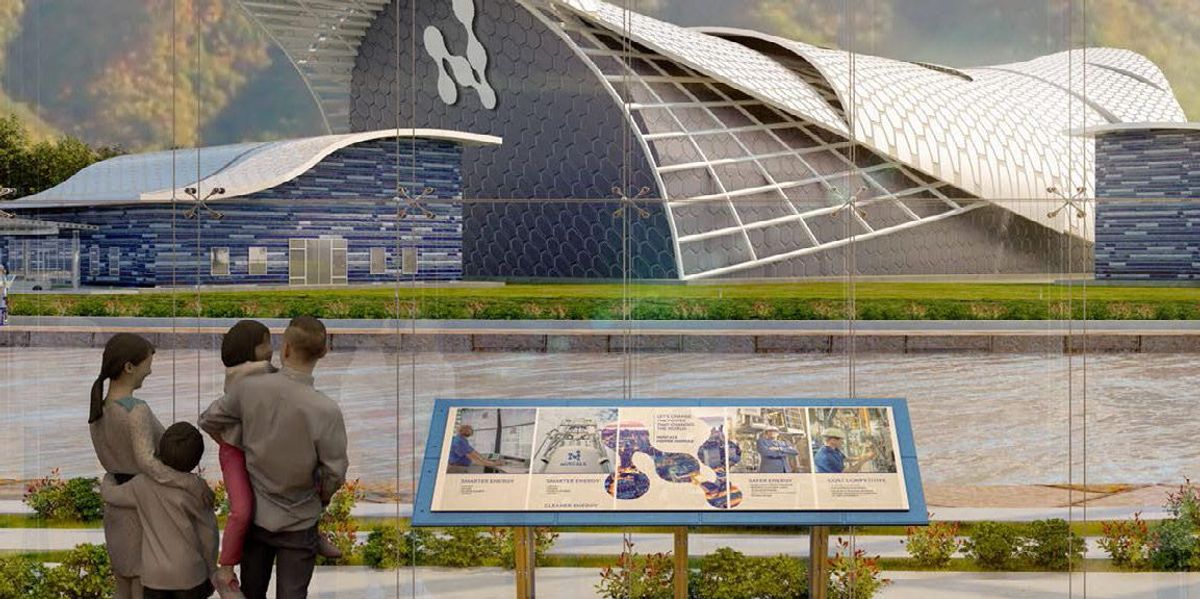

On the island of Hainan, south China, one doable future is taking form inside a compact labyrinth of concrete and steel. Final July, a crane hoisted the higher half of a metal containment shell into place. Slowly, steadily, employees are piecing collectively a miniature nuclear reactor.That is Linglong One, whose diminutive dimension is a drastic shift from the gigawatt-scale megaprojects that dominate nuclear vitality in the present day. But when one persistent cadre of nuclear optimists are proper, then Linglong One could possibly be a mannequin for fission’s future in an age of unpolluted vitality.Small reactors gained’t save the day fairly but; relying on the nation, there’s nonetheless loads of regulatory and logistical points to hammer out. However, consultants say, the 2020s may assist set the foundations for a nuclear blossoming in many years to return.If nuclear reactors had been plane, think about the SMR in the present day a 1910s-era biplane. And it’s nonetheless on the drafting board. “It’s a very thrilling time for the nuclear trade,” says Victor Ibarra Jr., a nuclear engineer on the Nuclear Innovation Alliance suppose tank.When it comes on-line in 2026, Linglong One can have a capability of 125 megawatts of electrical energy (MWe)—equal to round 40 onshore wind generators. Subsequent to a big reactor (usually in extra of 1,000 MWe), 125 MWe could seem insignificant. Why, in spite of everything, would an formidable nuclear reactor designer wish to go small?Partially as a result of giant reactors will be costly and delay-prone. The dual 1,110 MWe reactors at Georgia’s Plant Vogtle, the one ones beneath development within the US, will come on-line seven years not on time. The 1,630 MWe reactor beneath development at Flamanville in France has skilled greater than a decade of delays. Much more discouragingly, nuclear’s per-unit value elevated 26 % between 2009 and 2019—whereas photo voltaic and wind energy costs plummeted as a substitute.Nonetheless, a steadfast consensus stays that nuclear energy isn’t simply fascinating for a clean-energy transition—it’s crucial. However some nuclear advocates really feel that putting too many nuclear eggs in a single megaproject’s basket is a nasty thought. As an alternative, they suppose, a clean-energy transition could be higher served with a fleet of smaller, extra modular, reactors—like Linglong One. Therefore the identify: small modular reactors (SMRs).SMRs could also be smaller than in the present day’s common reactor, however they’re additionally cheaper, much less dangerous, and extra versatile. As an alternative of constructing an airport, one analogy goes, crafting an SMR is like constructing an plane. And if nuclear reactors had been plane, think about the SMR in the present day a 1910s-era biplane. And it’s nonetheless on the drafting board. As soon as the manufacturing course of scales up—if it ever scales up—SMR-makers hope to have the ability to fabricate their parts in a single manufacturing unit, ship them out, and have them assembled on-site like flatpack fission furnishings.Linglong One is the one one in every of its variety beneath development in the present day. If it’s a hit, China reportedly plans to make use of its design to energy untold variety of development tasks and desalination crops. Let a thousand flowers bloom. Other than two modified naval reactors on a ship within the Russian Arctic, each different SMR, in all places else on the earth, stays hypothetical. “I believe, within the subsequent 15, 20 years, there’s going to be an actual probability for SMRs to be commercially accessible and broadly deployed.”—Giorgio Locatelli, Polytechnic College of MilanBut SMR plans should not in brief provide. At the very least seven completely different builders plan to deploy SMRs within the US earlier than 2030. Most of them are demonstration reactors, not linked to the higher grid, however a vital stepping stone towards it.Maybe the biggest SMR model in the present day, a minimum of exterior of China, is U.S. startup NuScale. This firm has developed a 77 MWe SMR; they envision clumping 4, six, even twelve reactors collectively into bigger energy crops. NuScale has plans to construct a US plant in Idaho by 2030; the corporate is concerned within the UK, Poland, and Romania as effectively. (Necessary to recall, however, {that a} 2010 Spectrumstory on the way forward for nuclear vitality contained this projection: “NuScale is in talks with a number of undisclosed utilities and expects a primary plant to be operational in 2018.”)In December, Rolls-Royce shortlisted three websites in England for a manufacturing unit that, it hopes, will ultimately manufacture the parts for a 470 MWe reactor. Rolls-Royce hopes to get the primary of its reactors on the grid by 2029.Different European nations have expressed curiosity in SMRs, particularly in partnership with US companies. The Czech state-owned vitality firm put aside land within the nation’s South Bohemian Area for an SMR mission. Even France, a standard nuclear powerhouse, plans a billion-euro funding in growing an SMR trade by 2030.“I believe, within the subsequent 15, 20 years, there’s going to be an actual probability for SMRs to be commercially accessible and broadly deployed,” says Giorgio Locatelli, a nuclear mission professional at Polytechnic College of Milan in Italy.Many SMR designs in the present day name for a sort of gas that’s at the moment solely offered by one firm—a subsidiary of Russia’s state-owned nuclear vitality firm, Rosatom.And, but a countervailing power, regulation, has lengthy been infamous for making use of the cautionary brakes. A few of these regulators’ considerations come within the type of unanswered questions. Similar to their bigger counterparts, SMRs will produce nuclear waste. (In line with one latest Stanford and College of British Columbia research, SMRs yield extra nuclear waste than even typical nuclear crops.) What’s going to nuclear authorities do with that waste? Nobody is aware of, partly as a result of each reactor design is completely different, and nobody is certain what the SMR fleet will appear like in a decade or two. Furthermore, some analysts fear that unhealthy actors may co-opt sure SMR designs to create weapons-grade plutonium.Don’t extinguish the candle on SMRs past China’s shores simply but, although. A number of nuclear regulators have a minimum of begun to bend for SMRs.In line with Patrick White, a nuclear regulation professional on the Nuclear Innovation Alliance, the U.S. Nuclear Regulatory Fee (USNRC) has been amongst them, partaking SMR builders. In 2018, US Congress mandated that the USNRC create a brand new course of particularly for brand spanking new, future reactor designs. The end result, known as Half 53, is slated to grow to be an choice for SMR builders by 2027, although White says it might open up as early as 2025. What Half 53 will appear like isn’t but sure.The UK authorities, which has thrown its weight and funding behind SMRs, opened a modified regulatory approval course of to SMR builders in 2021; Rolls Royce was the primary to comply with, and 6 different companies have utilized. In June, French, Finnish, and Czech regulators introduced that they had been working collectively to evaluate Nuward, an SMR design backed partially by the French authorities; this mission, they are saying, is a dry run for future SMR licensing.The place, then, can SMR operators flip for gas? Most of in the present day’s giant nuclear reactors use gas with 3 to five % uranium-235—the naturally-available uranium isotope that may maintain a nuclear chain response. Whereas SMR designs are various, many will want gas that’s extra like 5 to twenty % uranium-235. This latter kind of gas is named high-assay low-enriched uranium (HALEU). As we speak, just one firm commercially sells HALEU: Techsnabexport (TENEX), a subsidiary of Rosatom—Russia’s state-owned nuclear vitality firm. Up to now, Rosatom has prevented Western sanctions over Russian aggression in Ukraine. However TENEX has nonetheless grow to be untenable for a lot of of its would-be clients. As an example, TerraPower, which hoped to change on an illustration SMR in a deprecated coal plant in Wyoming in 2028, delayed its launch by two years resulting from gas points.“Aside from allies of Russia, it’s not simply an impediment, it’s a flat-out barrier proper now,” says Adam Stein, a nuclear vitality analyst on the Breakthrough Institute.The US has began to pierce it. The 2022 Inflation Discount Act invested $700 million to analysis and develop methods of manufacturing and transporting HALEU throughout the nation. Ibarra welcomes the funding, however in response to him, it’s a “short-to-medium-term resolution.” It is probably not sufficient. One estimate suggests the replenished HALEU gained’t be prepared till 2028. For a lot of SMR-interested events, HALEU could also be a key objective within the years forward: establishing a worldwide HALEU provide chain that’s much less depending on Russia, much less inclined to international geopolitics. It stays to be seen how Europe or the UK will reply—in the event that they’ll let the US take the lead, or in the event that they’ll take motion themselves.From Your Web site ArticlesRelated Articles Across the Internet

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.