[ad_1]

Zillow is attempting to dump round $2.8 billion price of homes onto buyers after it purchased them with the intent of promoting them to hopeful owners and landlords, in line with a report by Bloomberg. This follows one other Bloomberg report that the actual property shopping web site needed to cease shopping for homes when it discovered itself with extra stock after the corporate informed buyers it deliberate on ramping up its flipping enterprise.

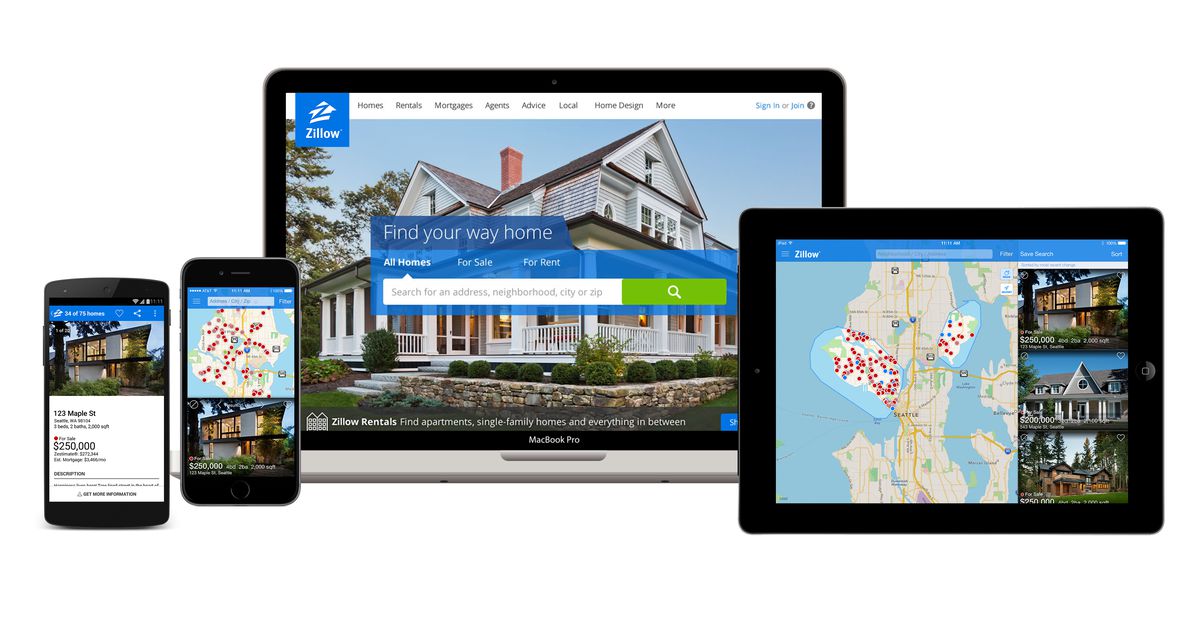

Some readers could also be stunned that Zillow buys and sells homes, fairly than simply appearing as a spot for actual property brokers to submit listings — I used to be too after I first heard about it, however the firm has truly been doing this for years via its Zillow Gives program. In response to its website, the concept is that Zillow will purchase your own home in money, streamlining the method considerably. It’ll then cope with any repairs or fast renovations after which promote the home itself. It’s not the one one with this enterprise mannequin both — competing actual property website Redfin has an analogous program, and there are whole corporations devoted to internet-based home-buying, like OpenDoor.

Zillow was in an “arms race” to scoop up homes all through the summer season

In August, a Vice article detailed what it described as an “arms race” amongst tech corporations that had been attempting to purchase up as a lot actual property as attainable as housing costs exploded throughout the nation. In response to the report, Zillow wager huge, telling buyers that it deliberate to purchase 1000’s of homes all through 2021 and switch its Properties division right into a billion-dollar enterprise.

Because the staggeringly scorching summer season got here to an finish, although, it appeared like Zillow’s Gives enterprise was additionally cooling down — in October, the corporate informed buyers that it might cease shopping for homes, citing development, renovation, and shutting labor shortages. Bloomberg, nonetheless, speculated that it may be motivated by extra stock and reported that Zillow appeared to promote a great variety of homes at a loss as an alternative of a revenue.

The housing market has been on a wild journey, and it’s most likely not Zillow’s fault

Now, in line with Bloomberg, Zillow is trying to offload round 7,000 of the properties it purchased. Sadly, it doesn’t appear to be particular person home hunters will be capable to profit from Zillow’s troubles — Bloomberg reviews that the corporate is attempting to promote the properties to “institutional buyers” (learn: Wall Road-like companies) to the tune of $2.8 billion. To would-be homebuyers who’ve been turned down attributable to a seemingly countless provide of money patrons, it could really feel like a slap within the face. Nevertheless, it doesn’t appear to be the housing market’s wild journey is completely attributable to funding bankers.

A report from Vox cites analysis that buyers solely made up about 20 p.c of the home-buying market in 2020, and Zillow says that it and its opponents made up round 1 p.c of the housing market in Q2 2021. In some methods, these numbers are each terrifying and reassuring — a fifth of the housing market is an enormous and influential chunk, but it surely additionally implies that it probably wasn’t a personal fairness agency (or Zillow) that outbid you in your dream house.

It’s laborious to inform what’s going to come of this sale and the way it’ll have an effect on Zillow’s house flipping plans sooner or later. Nevertheless, it most likely gained’t cease the conspiracy theories that Zillow is driving up costs on objective, and if I’m any indication, it gained’t make house hopefuls really feel any higher about their possibilities of scoring a spot to dwell. Maybe it’s simply one other information level for the argument that funds are a meme now and that betting huge doesn’t imply you’re going to get what you’re hoping for.

[ad_2]