[ad_1]

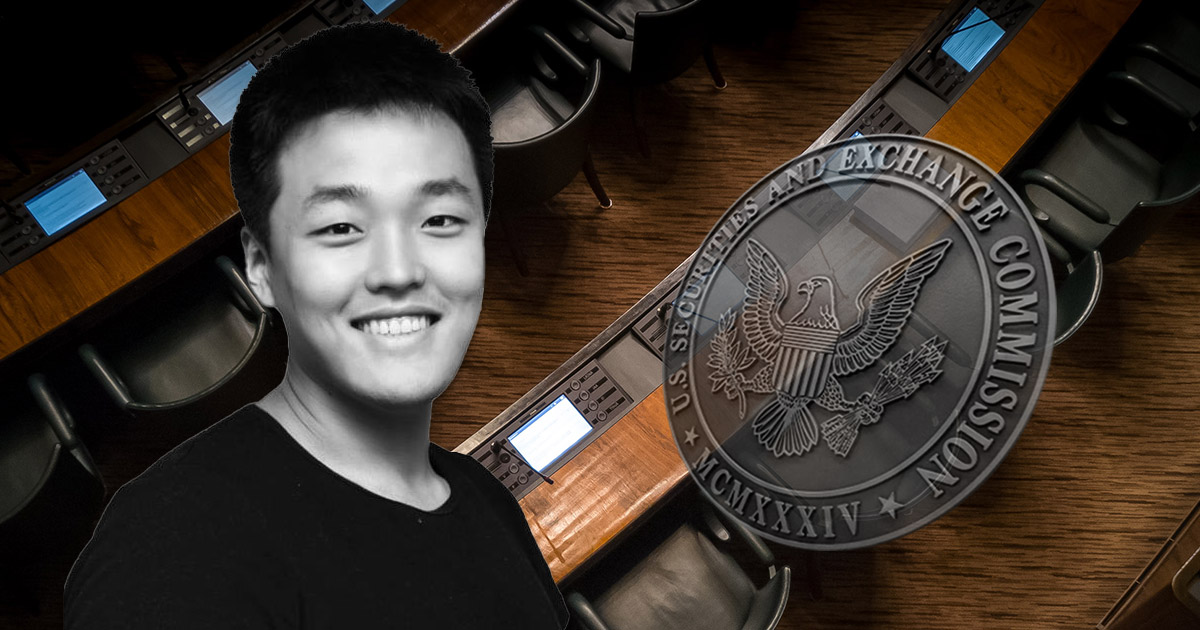

Do Kwon and Terraform Labs (TFL), the South Korean firm behind the blockchain mission Terra (LUNA), are suing the US Securities and Trade Fee (SEC), final week’s submitting exhibits.The lawsuit is available in response to subpoenas served to the co-founder and CEO of Terraform Labs on September 20, 2021, whereas in New York Metropolis attending a cryptocurrency summit.TFL and Do Kwon vs. SECAccording to the submitting, TFL and Do Kwon’s lawsuit towards the US regulator is “difficult two subpoenas improperly issued and served by the SEC and the SEC’s failure to maintain confidential an investigation into the ‘Mirror Protocol,’ all in violation of the Due Course of Clause, the SEC’s Guidelines and the APA.”[8] The Legislation (cont.)However by doing so, the SEC violated:the 14th Modification of the U.S. Structure;Part 555(c) of the Administrative Process Act;Title 17 of the Code of Federal Rules Part 203.8; andSEC Rule of Follow 150(b)— 카이사르리처드 닉슨 Hiram (@caesar_milhous) October 25, 2021TFL’s Mirror Protocol (MIR) permits customers to mint “synthetics,” which monitor costs of real-world property, equivalent to shares.“The subpoenas had been served on Mr. Kwon in public: Mr. Kwon was approached by the method server as he exited an escalator on the Mainnet summit whereas on his method to make a scheduled presentation that was not concerning the Mirror Protocol,” the go well with learn.The submitting argues that the US regulator acted “arbitrarily and capriciously,” because the service of the subpoenas “was meant to impermissibly safe private jurisdiction over Mr. Kwon and TFL in a approach that was not legally obtainable to the SEC.”Investigation into the Mirror ProtocolAccording to the submitting, the difficulty arose again in Might 2021, when two attorneys from the SEC’s Division of Enforcement contacted Kwon by way of electronic mail, requesting his voluntary cooperation in reference to a proper order of investigation styled “Within the Matter of Mirror Protocol.”TFL and Kwon retained Dentons US LLP to symbolize them in reference to the SEC’s request.Dentons and the SEC attorneys finally negotiated an settlement that Kwon could be interviewed by the SEC, whereby SEC agreed that his statements couldn’t be instantly used towards him or TFL in a subsequent case.Subsequent to the interview, which occurred in July and lasted roughly 5 hours, the SEC requested that Kwon and TFL voluntarily produce paperwork.“The request (1) partly sought data that weren’t obtainable and (2) was in any other case so broad and/or faulty that, to the extent responsive paperwork would possibly exist, the requests needed to be narrowed and clarified,” learn the submitting, including that “communications between the SEC and Dentons legal professionals ensued for the aim of reaching widespread floor for the voluntary manufacturing of data conscious of the SEC’s request.Throughout these discussions, the Dentons legal professionals requested suggestions from the US regulator on how the SEC considered TFL and Kwon in reference to its investigation.As famous within the submitting, “the SEC attorneys suggested that they believed that some form of enforcement motion was warranted towards TFL and that any cooperation, and implementation of remedial actions as to the Mirror Protocol, would end in a diminished monetary sanction as a part of any consent settlement.”As a substitute of specifying something in regard to the quantity of potential monetary sanction or any remedial actions or additional cooperation, Kwon was personally served by an SEC-hired personal course of service firm with subpoenas, looking for manufacturing of paperwork and Kwon’s in-person testimony in Washington, D.C.Get an edge on the cryptoasset marketAccess extra crypto insights and context in each article as a paid member of CryptoSlate Edge. On-chain evaluation Value snapshots Extra context Be a part of now for $19/month Discover all advantages Like what you see? Subscribe for updates.

[ad_2]

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.